In the update below, you will find the following links that will direct you to the topics and resources we have assembled for your benefit. I hope you find it informative and useful. If you have an extra second, read Section III: Around the MWA Office for some great updates. You’ll notice that Section II has been updated and we plan to have multiple advisors write so you get info from all of us. We are always trying to make this Quarterly Newsletter more informative and less wasteful, so give us feedback if you have any.

Best Wishes. – Mike

Section I: Market Update Slide Deck

Section II: Mike’s Update – Inflation, Market Decline, and Active Management

Section II-A: Matt’s Update – Where are My Stocks?

Section II-B: Stephen’s Update – How Likely is a Market Decline?

Section III: Around the MWA Office

Section IV: Articles of Value, Internet Videos, Podcast, and Recommended Reading

Section I: 3rd Quarter Market Update

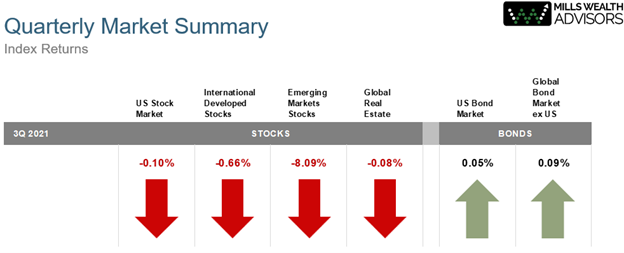

In MWA’s 3rd Quarter 2021 Quarterly Market Review (link) slide deck: You’ll notice that all Equity and Real Estate Market were down in the 3rd Quarter and that bonds stayed relatively flat. Returns since May have been mostly up and down, with not much growth since then in most markets.

Section II: Mike’s Update – Inflation, Market Decline, and Active Management

Some of you and we at the office, survived another Texas summer and just as the Markets did in September, the weather has begun to cool off. With my 50th Birthday just around the corner (on November 11th), I am closing in on a quarter-century in the investment business, and I want to share some old man wisdom now that I have more gray hairs than I can count, but remember, “Nobody knows nuthin!”

Adding Active Management:

It is hard to believe that with all the brilliant people in the money management business, somebody is not smarter than the rest of us, but the data shows that finding the next Warren Buffet is unlikely before he/she attracts so much capital it lowers the manager’s future returns. This is one of the reasons we tend to favor low-cost passive investments with the bulk of our equity portfolio. Despite this reasoning, we are beginning to introduce a few select, higher-cost active management investment strategies that complement the existing long-only portfolio. The new managers we have identified use different strategies one of which will invest in concentrated high conviction ideas. The other is a long / short strategy (A short investment strategy profits from declining markets).

We believe these strategies will perform differently than the remainder of our “passive” portfolio. The stimulus, money printing, and pent-up demand all are likely to add up to more short-term inflation, which normally causes rising interest rates (bond prices work like a seesaw when rates rise, bond prices fall. It is, for this reason, we think over the near term the environment for longer duration bonds is unattractive and that now is the time to bring in additional strategies that can help us add defense in other ways than just high-quality bonds. The strategies we are adding should perform differently than a portfolio of stocks (for growth) and bonds (for defense).

Diversification is our friend, and more is better. I think when we enter periods of extremely high valuations (which could lead to lower future returns), I would prefer to have various forms of defense. In market environments like today, I’m more concerned with protecting gains, than subjecting portfolios to additional risk, esp. if the financial plan is ahead of projections or what is required to fund your goals.

“Do you think the markets are going to crash?”

Markets are either setting new highs or are retreating from highs, so just because prices are high that does not mean a crash is imminent. There is a lot of cash on the sidelines which is a positive sign. And while the United States’ market valuations are high, valuations are much more reasonable throughout the rest of the world. I am of the opinion that the rest of the world is at least half a year behind the US.

I think it is important to remember that today’s prices reflect all known information (as of today) for every market player’s consensus estimate of what the future holds. There are plenty of differing opinions, on what could be in store for markets in the future. Some will say the mother of all crashes is coming, others will say profits fueled by global stimulus and consumers flush with cash will drive profits and more than justify today’s high valuations (even with the supply constraints in shipping, the chip shortage, or the rise in energy prices, and COVID Delta variant. I do not believe we can know for sure which thesis will be proven correct or if another outcome will develop, but I think it is important to remember that the reason we get paid to invest in markets is that the future is inherently uncertain.

Economic environment:

- Inflation will likely run hotter than industry stats show and that the Fed expects.

- This has recently changed in prices most noticed by the 10-year yield jumping from 1.25% to 1.55% in a few days. We think it will keep rising a little more. As it approaches 2%, we plan to extend the duration on safer fixed-income assets as that likely gets us some more defense if there is a pullback or flight to quality.

- I do not expect high inflation as we saw in the 1970s, plus the world wants is continuing to send their dollars here to invest.

- Long-term I think that Disinflation (a lighter form of Deflation) is likely and scarier for the Fed than inflation. With the 3-Ds increased debt in the developed world, demographics (aging populations leaving the workforce), and disruptions from technology will keep price inflation under control longer-term as high prices are the cure for high prices. Shorter-term we are positioning portfolios in anticipation that prices will continue to rise. Rapid increases in the cost of food, gas, homes, autos, etc. will all work together to slow down some of the pent-up demand and resulting inflation.

- We are keeping our fixed-income bond Investment durations very short in case rates rise.

- Buy the Unloved: Massive amounts of debt and fiscal stimulus could lead to a weakening dollar which could finally give a boost to many overseas assets. Our portfolios are overweight International Assets as we think their lower valuations make them better positioned to profit over the next 5 years.

- Our Global Exposure to Value gives us more exposure to U.S. Financials, Oil and Gas, Materials all areas that should benefit from a steepening yield curve and rising inflation expectations and should do well as yield curves steepen, rates rise.

I like to remind people that while there are many ways to invest at the end of the day it usually boils down to buy low sell high, or sell high buy low, or buy, buy, buy and never sell. All these strategies work if we master the emotional aspect of investing and survive the roller-coaster nature of changing prices.

I believe it is extremely important to reassess your risk as conditions change in your life. Prices will change every day as will your goals, that is a certainty. As your investment values rise above the cost of your goals, I think it is prudent to re-evaluate your risk profile. Because portfolios have increased in value, we need to decide if we should sell gains and realize taxes to lower risk or keep the gains which can increase your original risk profile. Taxes are always a consideration in non-IRA accounts. We will be resending our short risk questionnaire over the next quarter to help you think about this important decision and our team looks forward to having these conversations with you between now and the end of the year.

Thank you for allowing us to help you reach your goals. We feel confident that if we diversify globally, keep costs low, continue to minimize tax, make double sure that your need for risk matches your plan, and that we can remain invested throughout the temporary declines that we will be successful. We plan to continue to buy the unloved. Reversion to the mean is and will remain the strongest force in finance and that will eventually make the unloved become the loved.

Section II-A: Matt’s Update – Where are My Stocks?

One question you might ask about your investment portfolio is, “Why don’t I have any individual stocks?”; you should also know that Mike, Stephen, and I hardly own any either! The main argument against picking individual stocks is: most people, including professionals have a hard time beating the global indexes, so why bother? You can browse the SPIVA report for every equity market worldwide and what you will notice is, over a five-year period 75% of funds do not beat their benchmark. Even more alarming, this 75% consists of professional money managers working with full teams of analysts.

Instead of focusing on professionals, let’s bring this back down to the average investor, how confident are you of your ability to pick individual companies? There are certain areas of life where the amount of time it takes to judge someone’s skill is relatively short. Whether it is a baseball coach or someone speaking a foreign language, you may get lucky early on in proving you can hit and field or hold a conversation, but eventually, a trend will form to highlight your actual ability: think batting/fielding percentage or proper pronunciation, use of tenses and semantics. How long could we expect to determine if someone is good at picking stocks? I would say, multiple years, and even then, we might not know with any certainty. Even if your decisions end up making money, you can still lose when ultimately comparing yourself to the S&P 500 or EAFE (Europe, Australasia, and Far East).

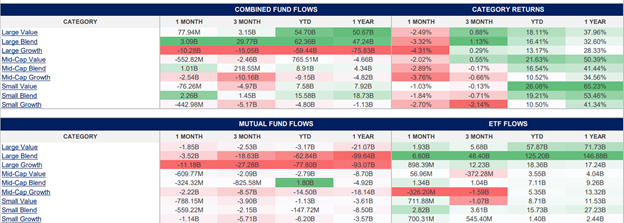

More importantly, the final results achieved may have no relation to the reasons you chose stock A, B, or C. Imagine purchasing Gamestop (GME) or AMC (AMC) because you believed the company would revamp their operations and services, next thing you know, the price skyrockets due to a constant barrage on short-sellers (short squeeze). During my time working in the risk management department for a large brokerage company, I saw successful traders who made life-changing money but also saw many others who lost everything. Choosing the right companies, at the right time, is incredibly hard to do; so, what the chart below highlights is, since 1990 we have seen a steady increase in the number of investors utilizing stock funds (mutual funds/ETF’s) rather than individual holdings.

In a study, Can Mutual Fund “Stars” Really Pick Stocks?, researchers found that “the large, positive alphas of the top ten percent of funds, net of costs, are extremely unlikely to be a result of sampling variability (luck).” This suggests that 10% of people who pick stocks professionally do have a measurable skill that lasts over time. Nevertheless, that suggests that 90% probably do not. In knowing that, why participate in something where you cannot prove if you are skilled at or at least making progress? If you wanted to give it a shot, sure, take a small percentage of your money and see how you do, but outside of that, why devote serious time and energy to stock picking? Making money, slowly over time, never sounds like the most attractive option, even Jeff Bezos asked Warren Buffett, “…your style of investing is so simple. Why doesn’t everyone just copy you?” and he responded, “…because nobody wants to get rich slowly.”.

Section II-B: Stephen’s Update – How Likely is a Stock Market Drop?

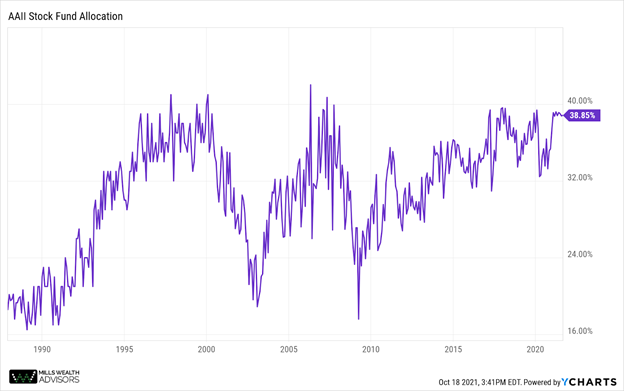

A hot topic for the past few months has been discussions around how quickly the US Stock Market recovered from the fall due to the Covid pandemic and how there is a growing concern for a market drop stemming from inflation, low interest rates, higher price to earnings/price to book and more. To be clear, I’m not here to call a market decline in Q4 of 2021, in 2022, or anything like that. However, I thought it was an interesting topic to discuss because market corrections happen much more often than we think. There was a post I saw a post a few weeks ago that has been heavily on my mind and would like to discuss the history of market declines, specifically in the S&P 500 because of it.

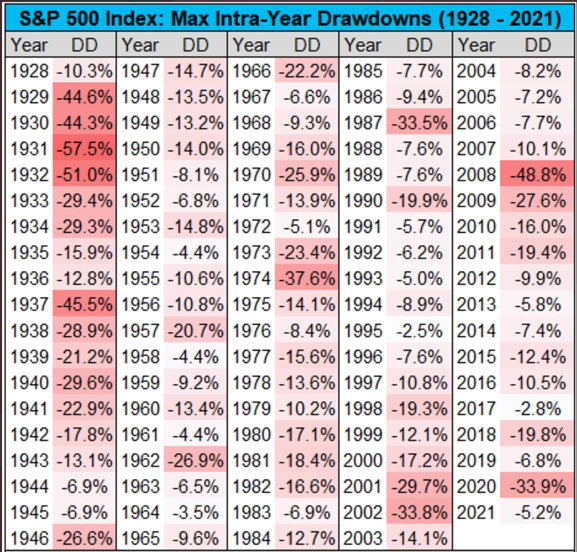

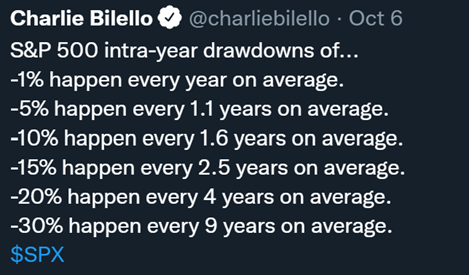

A fellow advisor, Charlie Bilello, posted a picture on Twitter showing the intra-year declines of the S&P 500 going back to 1928. An intra-year decline would be a decline at any point in time during a given calendar year. For instance, in 2020 there was a 33.9% decline from the Covid pandemic, which shows in the graphic even though the S&P was positive during the year. You’ll notice that just about every year there is at least an intra-year 5% drop, on average it happens every 1.1 years.

Now let’s get into the numbers. As you would expect the bigger market declines happen less often than the small ones. However, I was very intrigued about the frequency of 15-20% declines. In the past 3 years, we have had two separate 15% or more declines, which happen about every 2.5 years. One of them being 2020 which was over 30% but would still be at least 15% and 20%. I was surprised to see that 20% drops happen, on average, every 4 years. Below you can see the breakdown as Charlie tweeted it out.

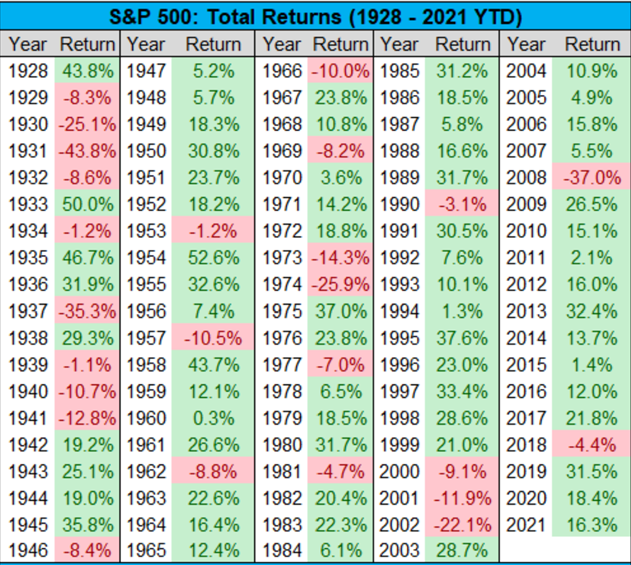

Just because these intra-year drops happen every so often, doesn’t mean that have to, it just means they can. The data may be a little skewed due to starting right when the great depression happened, but whether a 20% drop happens every 4 years or 5 years is neither here nor there. The important thing to take from this is that market drops happen much more often than we think. Even during one of the greatest bull markets in history, there were two 19% drops, a 16%, a 12%, and 10% drop during them, but we often forget about that because the calendar year was positive. So don’t be worried about market declines, be prepared for them.

How Can I Be Prepared for a Market Decline?

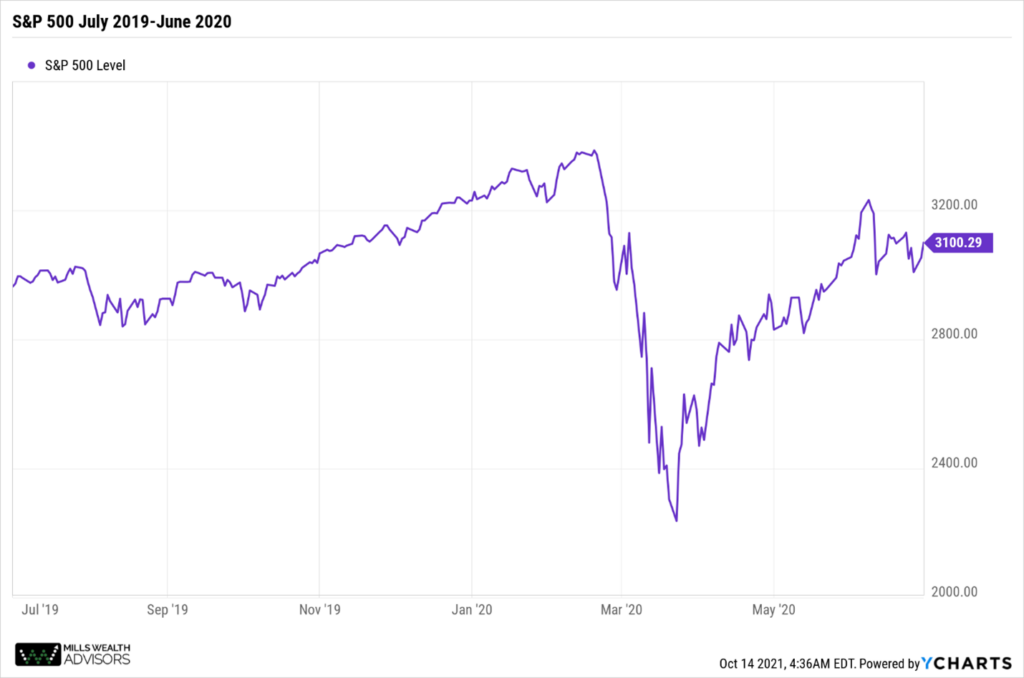

It is hard to say how the best way to prepare for a market decline is because they come in different situations and scenarios. However, I can tell you how we have prepared our clients in the past for market declines. If you go and look at our blogs, you can find an article in September of 2019 in which we discussed how much longer can the then-current S&P 500 Bull Market last? (a bull market is a market that continually goes up without a 20% decline, the most recent went from 2009-2020) In the article, we discussed the importance of making sure your allocation is in a place where you can handle a decline.

Fast forward 6 months, March 2020, the S&P 500 was down over 30% and we were calling clients asking them if they were prepared to rebalance into the decline (by this we mean rebalancing our assets more aggressively than previously). We were extremely proud when over 95% of our clients said, “Yes if you think it’s right, let’s do it”. I’ll point out that the 5% who didn’t, had valid reasons for not doing so (not feeling the need to increase risk based on their current financial plan being on track without the increased risk).

Today we are having similar conversations with clients, revolving around current risk allocation and whether based on current market conditions it is the right decision for them personally. I think each investor should routinely take time to assess their current allocation versus the current market situation and make sure it fits their goals and comfort level to have a better investment experience.

Now What?

The takeaway I hope you have from this is that market declines are not something to be surprised by or scared of. They are something that we should always be prepared for, and game plan for. People who are “ready” for the declines in the market can make better, less emotional decisions on their finances. And remember the reason we take the risk of losing money as we have talked about is, it is much more likely that we will make money in the long run. Look below at the actual calendar year returns of the S&P 500. There are much more green years than red years. So do not be afraid of market declines because they are rarer than markets being positive, and if you are prepared you will make the correct decision when they happen.

Section III: Around the MWA Office

Where do I begin? First of all, thank you to everyone who provided feedback in our client survey. We had the most responses we have ever received, and it will help us out tremendously as we give you better service. Look for an email regarding it next week on what we learned and how we are going to improve.

As we mentioned in our last newsletter, Matt Brown got a promotion and is now a Service Financial Planner which created a hole in our Associate Financial Planner role. We just finished the hiring process on our first hire and sent out an offer letter to one today and hope to have another hired by the end of the year.

Section IV: Videos, Podcast, & Recommended Reading

- Podcast on Precious Metals: https://podcasts.apple.com/us/podcast/we-study-billionaires-the-investors-podcast-network/id928933489?i=1000538642493

- Estimates on Taxes: https://www.taxpolicycenter.org/model-estimates/tax-provisions-administrations-fy2022-budget-proposal-june-2021/t21-0061-tax

- Will Inflation Hurt Stock Returns?: https://www.millswealthadvisors.com/wp-content/uploads/2021/10/Will-Inflation-Hurt-Stock-Returns_-Not-Necessarily.pdf

- Are You Being too Risky with Your Investments in the Market?: https://www.millswealthadvisors.com/risky-investments-market/