I read an article today that I think reflects what we are thinking at Mills Wealth Advisors right now. Now, I don’t agree with 100% of what was written, but the main premise I agree with very much.

We have been having many conversations with clients about their current risk appetite and whether or not it would be prudent to lower risk right now. With the run up of the market recently, it may be time to rethink the risk you are taking. I’d like to use a story most will know to elaborate.

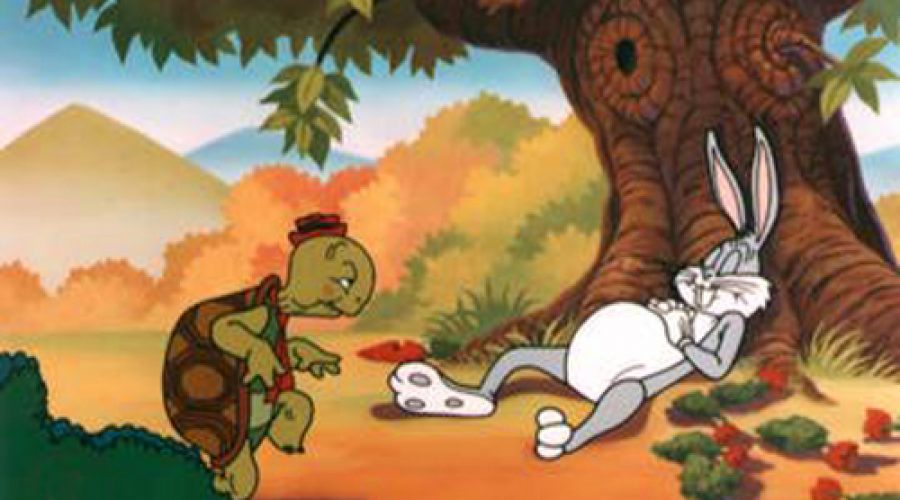

The Story – The Tortoise and the Hare

Think of the story of the tortoise and the hare, the way many of us wish the market performed would be like the tortoise. Slow and steady, never changing, always moving forward, never resting or going backwards. However, how the market performs is really like the hare. It runs fast in short burst and then tires and “rests”, (it may even go backwards, unlike the hare in the story). The hare (market) just ran as fast or faster than it ever had, even after a very short nap (the short bear market of March 2020), so I would like to think that a rest for the hare (market) will be coming. We don’t know when or how long it would be, but we know its coming, the hare always stops for a rest. So for us to prepare for this rest it may be best for us to lower our risk a hair (no pun intended). If you currently are 100% invested in equities maybe consider 90% equities, if you are 60% equities consider 50% equities. By doing this we may lose out on a little return, but I think you will sleep better at night when the market takes a rest, and you can fully jump back in during the rest.

If you are interested in the article I mentioned by Frank Holmes, click here for the webpage or here for the PDF.

Thank you for reading,

Stephen