“Far more money has been lost by investors preparing for corrections than has been lost in corrections themselves.” –Peter Lynch Legendary manager of the Fidelity Magellan Fund

Happy New Year! I hope your holidays were filled with love and laughter. As we close out 2021, I am happy to report that MWA’s models posted strong returns for the year and that our clients are closer to reaching their goals today than they were a year ago. Unfortunately, as prices/valuations rise, future expected returns tend to decline, as some of tomorrow’s gains are pushed into today by government policies and expectations about the future. There is a saying on Wall Street “The market makes something cheap every day”. However, today as prices rise, it gets more difficult to find investments that I believe can confidently deliver attractive risk-adjusted returns over the intermediate-term. In this newsletter, I address some of the questions we wrestle with every day and the tradeoffs we must choose between, as we guide you toward financing your goals. As always, if you would like to review or revisit your current plan or the investment allocation (mix between offense and defense) inside your plan, contact our office to set an appointment. Thank you for the trust and confidence you have placed in our team. Cheers to 2022 — Mike

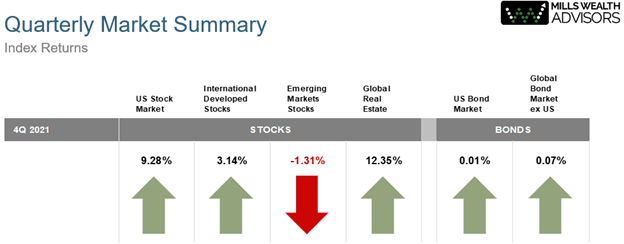

Section I: 4th Quarter Market Slide Deck

In MWA’s 4th Quarter 2021 Quarterly Market Review (link) slide deck: You’ll notice that most Equity and Real Estate Markets were up this Quarter and that bonds stayed relatively flat. Returns since May have been mostly up and down, with not much growth since then in most markets.

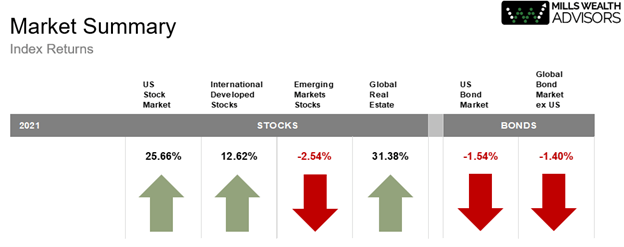

Section II: 2021 Market Slide Deck

In MWA’s Annual 2021 Market Review (link) slide deck: You’ll notice that the US Market and Global Real Estate were the main drivers of returns in 2021. US and Global Bonds both returned negative results, with US Bonds slightly lagging. Emerging Markets that typically thrive on travel and production were hurt from the effects of the COVID-19 Pandemic and had the lowest return of all in 2021.

Section III: Market Commentary

Bullet Points on today’s Current Environment:

- Very low interest-rates around the world

- Record amounts of stimulus

- Strong Gains in Equities and Real Estate

- The United States stock market has grown to 60% of the global market up from 45% of the world Market size just 10 or so years ago.

- Highest inflation in 39 years 6-9% (I think CPI understates inflation for most people)

- Stimulus and pent-up demand have led to strong consumer spending and global supply shortages, backlogs, rising prices, and long wait times on goods.

- Housing prices have had large jumps in value

- Fed is about to taper its long bond purchases, could this lead to a recession?

- Many expect 2-3 short-term rate hikes in 2022 early 2023 to try to tame inflation. Higher borrowing costs could help banks and financials and add cost to some businesses.

- Oil ended the year above $80/ barrel. Constrained supply could drive prices higher as the rest of the world economies continue to reopen from pandemic slowdowns

- Equities finish the year with strong gains across the board. Emerging markets were one of the weaker market areas from late year China selloff, despite low valuations and dividend high yields.

- Most fixed income markets end with negative returns, and rising interest rates and inflation are causing investors to be increasingly riskier with their portfolios.

Bull Case for staying invested:

In the chart above, the Fed’s policy of low-interest rates has spurred demand and has finally caused wages to inflate. Governments around the world have primed the pumps and artificially held rates low to start the global economic engine. Now there is a lot of cash on the sides, money has continued to flow into dollars as US yields are higher than many of the other developed markets. Jeffery Gundlach the founder and chief investment officer of Los Angeles-based DoubleLine Capital, a leading provider of fixed-income investments said in his 2022 Forecast, “Equities are Expensive, but they are cheap relative to bonds” (Huebscher). Much of the world’s defense is looking for a home and faced with expensive bonds and with inflation starting to take hold, money continues to find its way to equities or negative-yielding cash short-term bonds. Why are equities still rising in value despite high valuations? Companies can raise prices which can reduce the effects of inflation on profits, fixed income investments do not have this luxury. Just because valuations are high in some market areas does not mean equity prices must fall. US markets led by technology are more expensive when compared to other world equity markets, but at some point, capital will tend to seek out investments with the most potential. Mr. Gundlach thinks the dollar may weaken over time which could act as a tailwind for overseas investments in dollar terms. (gunlach)

I think it is always important to remember that diversified portfolios will eventually go higher. About 30% of the time, they will go lower before they go higher, but either way, they will eventually go higher. How much higher can sometimes be hard to grasp. “If $1 could be invested today at the historic compound return of 10.5% per year, it would grow to $147 in 50 years. One might argue that economic growth will be slower in the years ahead than it was in the past, or that bargain stocks were easier to find in previous periods than they are today. Nevertheless, even if it compounds at just 7%, $1 invested today will grow to over $29 in 50 years.” (Oaktree Marks 1). So next time you are debating investing a dollar or spending the dollar, you might view that dollar as a $30 bill.

Over the past 3 months, we have seen some of the most expensive stocks with no earnings return to earth falling nearly 30%. Half of the NASDAQ is now trading below its 200-day moving average (Gunlach). The gap between growth stocks and value stocks is still historically wide. But even today, “history offers abundant evidence that investors around the world will be rewarded for the capital they provide.” (Marks). Meaning that even when stocks are expensive, they are stilled priced to deliver positive long-term returns otherwise investors would not buy or sell and take their capital somewhere else. Billionaire investor David Booth said “Over the long haul, research shows that value stocks on average outperform growth. We think there is a good reason for that. It’s lower-priced stocks and basically the lower price you pay for something the higher the eventual return.” (Booth)

Markets have had a pretty good run, how often do markets fall, and by how much?

Since the end of WWII, the market has had 14 bear markets (one about every 5 years). The average decline in these temporary pullbacks has been about 30%. I think it is important for investors to maintain a long-term perspective because markets rise much more often than they fall. The Fed’s policy of near-zero interest rates combined with global stimulus has created one of the strongest market environments since the Reagan tax cuts in the early 1980s and many think the Fed is trapped between inflation and deflation. If they fight inflation too aggressively, they could push us toward deflation which might cause them to revisit QE policies that seek to push up asset prices. In this environment, it is good to own equities.

As inflation continues to erode purchasing power and interest rates begin to rise, consumers costs rise which can eventually lead to reduced profits or reduced consumer spending. I do think caution is warranted in today’s environment and I believe that it is prudent to have a little more defense than whatever is normal for you, but I would not recommend making an all-in or out bet.

What are some of the ways to add defense to a financial plan, or a portfolio?

- Save more.

- Take some of the recent gains and pay off some debt.

- Automatically invest the old payment that was going to pay the debt and systematically invest it each month into some of the most out-of-favor areas of the market.

- Add more defense to your allocation just be aware that, with inflation running hot, funds allocated to safer more defensive strategies might lose purchasing power, even if they make a small amount of money

- Own diversified assets across the globe that zig and zag at different times

I just want everyone to remember even money deployed today in a low cost, diversified prudent strategy with both offense and defense rebalanced with new savings will make money in the future, so do not get paralyzed by fear of loss, stay optimistic, ignore the noise, and stick to your plan.

Should we sell today while valuations are high and buy back in after markets pullback? I believe this is a hard way to win and attempting this strategy will probably cost you more than you will make. We are not in the market timing business; you must be right twice when being right once is hard enough. I’ve never seen anyone (yet) get completely out of the market when prices are high, and then get in again when prices are low? I have seen people get out before prices fell; I have just never seen them do both (getting out near the top and getting back in near the bottom). I think a more reliable strategy and one we recommend to clients is to take a more balanced approach. When you think markets are high (and the margin of safety investments like stocks are offering is lower than you would like, then caution is probably warranted. First off never violate the 5-year rule: if you know you are going to need money within 5 years, do not invest in stocks or other risk assets.

Additionally, high valuations present a good time to reassess your risk tolerance and capacity to endure a bear market. Maybe you pay down some debt with the gains (or with current savings rather than invest it). Instead of making an all-in or all-out bet, you build up 10-20% more defense than your normal target. That way if markets pull back you can deploy the extra funds you raised, if markets keep going higher then you still have more than half your money benefitting from those gains. In 1995 markets were expensive, but you should have seen them after 1996, 97, 98, and 99 before they finally fell in 2000.

“The truth, however, is that buying or holding – even at elevated prices – and experiencing a decline is in itself far from fatal. Usually, every market high is followed by a higher one and, after all, only the long-term return matters.” (Howard Marks )

To Wrap Up:

I have no idea if 2022 will be the year the market finally pulls back or if it is another year where the market continues to add to its winning streak. Here are a few things I am sure of: Investment success is inevitable if you stick to the plan by keeping a long-term perspective, maintaining prudent diversification along the way, and minimizing frictional costs that could lower returns. Saving a little more than is necessary and adjusting risk as circumstances change are two simple strategies that can improve outcomes. If you follow this playbook the market will eventually toss you up an investment that is too good to pass up or an environment that is worthy of turning your defense into offense. As your advisors, I can promise we do not know the future any more than you do, but we will continue to search for the best ideas that will lead to more effective execution. We will continue to be cautious, and to create flexible plans that attempt to help you accomplish your goals sooner and safer. If experience has taught us anything, it is that avoiding mistakes can lead to great long-term outcomes and eventually turn $1 bills into $30 dollar bills or even $100 bills, so stay disciplined and allow the miracle of compounding to work for you.

–Mike Mills, CFP

Managing Principal

Section IV: Around the MWA Office

New Associate Advisor – Taylor Sellers

Taylor joined the MWA team in November 2021 as an Associate Financial Planner.

Before joining MWA, Taylor spent over 8 years in the Oil & Gas industry as a geologist. He started working in Pennsylvania and West Virginia on the rig sites before coming to the great state of Texas in 2011 to work for Pioneer Natural Resources. After 7 years with them, he realized his passions laid elsewhere in the world of Financial Planning. He left Pioneer and joined Equitable Advisors in Dallas as a Financial Professional. In his year and half at Equitable, he developed the passion for helping and advising clients, specifically during a tumultuous time in the Oil & Gas industry. Taylor joined MWA to make a difference in the lives of clients by educating them to make smart financial decisions.

Taylor and his wife, Stephanie, were married in March 2021 in Aubrey, TX. No children yet, but they plan to start the family very soon. In his spare time, Taylor loves to play golf and go on adventures with his wife and dog, Indy.

New Partner – Stephen Nelson

We are in the final stages of promoting Stephen Nelson to Partner. Stephen has done an amazing job in the nearly 5 years that he has been here, and we are happy to make a long-term commitment to him and his family. Speaking of family, we are pleased to welcome Stephen’s new baby boy, Tate, to the MWA family this year.

Section V: Videos, Podcast, & Recommended Reading

-Howard Marks:

https://www.advisorperspectives.com/commentaries/2022/01/14/selling-out

–David Booth interview:

https://money.com/dfa-david-booth-value-stocks-bitcoin/

–The Remarkable Accuracy of CAPE as a Predictor of Returns

by Michael Finke, 7/20/20 Michael Finke https://www.advisorperspectives.com/articles/2020/07/20/the-remarkable-accuracy-of-cape-as-a-predictor-of-returns-1

–Gundlach’s 2022 Forecast: Equities are Expensive but Cheap Relative to Bonds

by Robert Huebscher, 1/12/22 https://www.advisorperspectives.com/articles/2022/01/12/gundlachs-2022-forecast-equities-are-expensive-but-cheap-relative-to-bonds