The beautiful spring weather of April is here, and it’s hard to believe that another quarter has come and gone. This quarter marks a significant milestone for Mills Wealth Advisors, as it was 25 years ago that the firm was founded. In that time we have seen the Dot Com Bubble burst in the early 2000s, the Great Recession in the late 2000s, one of the greatest bull markets in history during the 2010s, a global pandemic in 2020 that, when looking back at, feels like it was out of a Sci-Fi film, and, to close it all out, one of the worst bear market bond markets ever recorded.

Going through all of that, we have learned a great deal, and continue to learn and use our knowledge to make sure that you, as clients, reach your goals in the safest fashion possible. We are honored to have your trust and will continue to do our best to help you reach your goals, no matter what the market throws at us, and if history is any indication of the future, we know there will be more issues ahead of us, and we will be ready.

SECTION I – QUARTERLY MARKET REVIEW

SECTION II – MIKE’S COMMENTARY, QUESTIONS, AND QUOTES

SECTION III – TAX CORNER – ESTATE TAX SUNSET

SECTION IV – AROUND THE MWA OFFICE

SECTION V – PICTURES WORTH LOOKING AT

Quarterly Market Review – Slide Deck

The 1st quarter of 2024 was off to a hot start with most of the markets up. The Stock Markets across the world were up in the 1st Quarter with the US Stock Market leading the way at 10.02%, followed by the International Developed Stocks at 5.59% and Emerging Markets Stocks at 2.37%.

The rest of the markets were mixed with the Global Bond (ex US) up by 0.58%, the US Bond US Bond Market down by -0.78% and Global Real Estate with the sharpest decline at -1.19%.

The good news is that all of these markets have been up over the past 1, 5, and 10 years. To see the full Market Review Deck CLICK HERE

Mike’s Commentary, Questions, and Quotes

Today I’m going to begin with a brief review of the recent market rally. Then, I will discuss the implications of this rally, and how we may recommend changes to client allocations. Next, I’m going to highlight quotes from the 3 Investment Superstars listed below. Their recent client letters or papers are sounding warning signs to investors who own broad size-weighted index strategies made up of America’s great businesses (like the NASDAQ, S&P500, among others):

- Jamie Dimon, Billionaire CEO of JP Morgan Chase,

- Jeremy Grantham, Billionaire Co-Founder of GMO

- John Hussman, PhD. Founder of Hussman Funds

For anyone that wants a refresher on how bonds work compared to CDs or money markets, this article offers a refresher on bonds and how we use them in portfolios for defense. As interest rates rise to more normal levels (around 5%), We think bonds might be especially attractive today when compared to equities on a risk and return basis.

Question to consider: What allocation changes, if any should we trade for your portfolio given your expected savings, future spending, and taxable gains in your portfolio? (Rotating money from offense to defense it may trigger a tax).

These are questions we may want to explore 1-1 after you read this update.

The last 2 quarters have produced extremely strong investment gains, some of the best in recent history. Today’s overall investment climate has many reasons to price investment assets more pessimistically than they are currently priced. Throughout this update you will notice a common theme: Large US stock’s record profit margins, combined with their extremely high valuations, could stall out or fall if the US economy enters into a recession, faces higher interest rates, or some of the world’s geo-political risk eventually affect prices. Any one of these issues by itself could lead to lower valuations, so the fact that we have had strong performance, now might be the time to take a little extra off the “table” and put in your “pocket” (meaning switch some more offensive investments to defensive investments or add additional strategies that may zig if markets zag.)

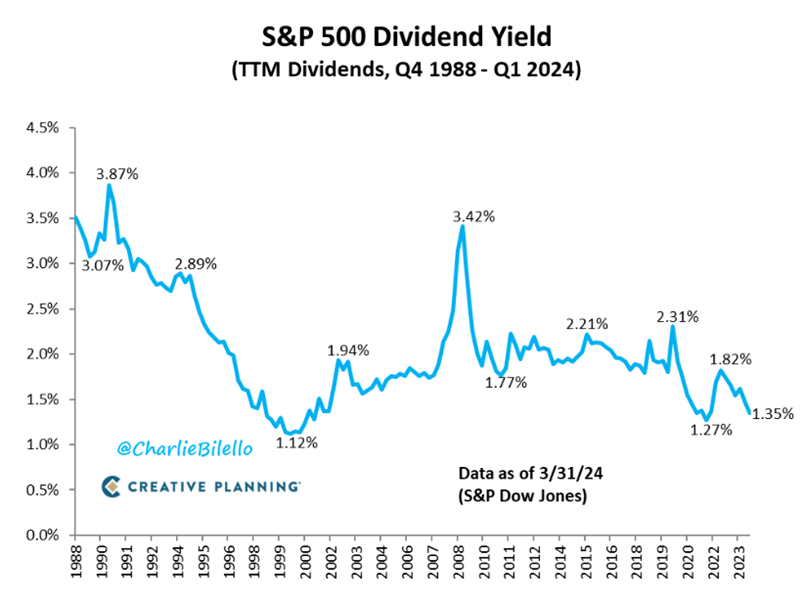

Today fixed income assets are paying decent returns relative to expected inflation. We can earn between 5%-6% with very little risk and I’m afraid that most broad, size weighted, US indexes will have a hard time earning those type of returns over the next 7-10 years. Should equities decline and valuations offer a better risk/return profile, we can always move the funds back to higher risk assets.

Now I realize most of this letter is not very optimistic, and I would much prefer to be an optimist, but I think there are a few times where the odds just favor not playing the game. Our portfolios are tilted to high-profit companies and to smaller undervalued companies, two of the areas that offer the better chances of future success, outside of maybe metals, and other resource stocks that have had major under-investment during the past decade. Our portfolios already have larger weightings to these areas, but we are considering adding a dedicated fund to further overweight these very unsexy investments in some risk profiles.

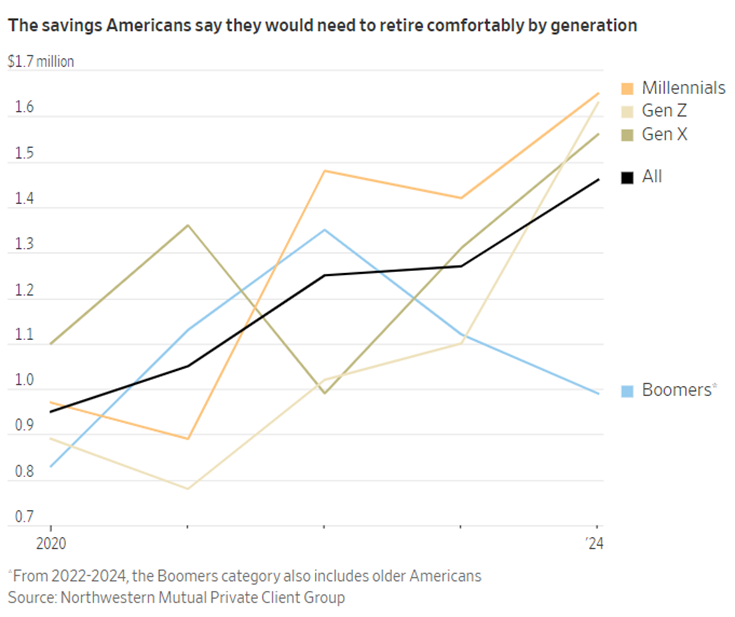

I believe the primary job of an advisor is to keep our clients focused on their goals, and the strategies that accomplish those goals, in the safest, highest probability manner. To do this, we mostly use broadly diversified, low-cost investments, then we minimize taxable trades, typically favoring equities because of their long-term return potential, especially when clients have a 10+ year time horizon. As you know we track these goals in our financial planning software, and at each meeting we are reassessing risk vs. the possible returns that are likely within the time frame available until some of the funds are needed. Most goals are usually longer-term in nature like saving for college, setting aside money for retirement, getting ready for a large expense like a wedding. As we approach goals that are mostly funded, we like to reduce the possibility of a market loss un-funding these funded goals! Strategically, we do this by moving offensive investments to defensive assets, usually about 5-years before we need to spend the funds (today we are considering extending it to around 7-years because safer assets like bonds appear likely offer a higher risk adjusted returns).

Because of today’s high valuations and a host of other less than optimal factors that could reduce stock values, we are advising clients to consider continuing to be more cautious than normal.

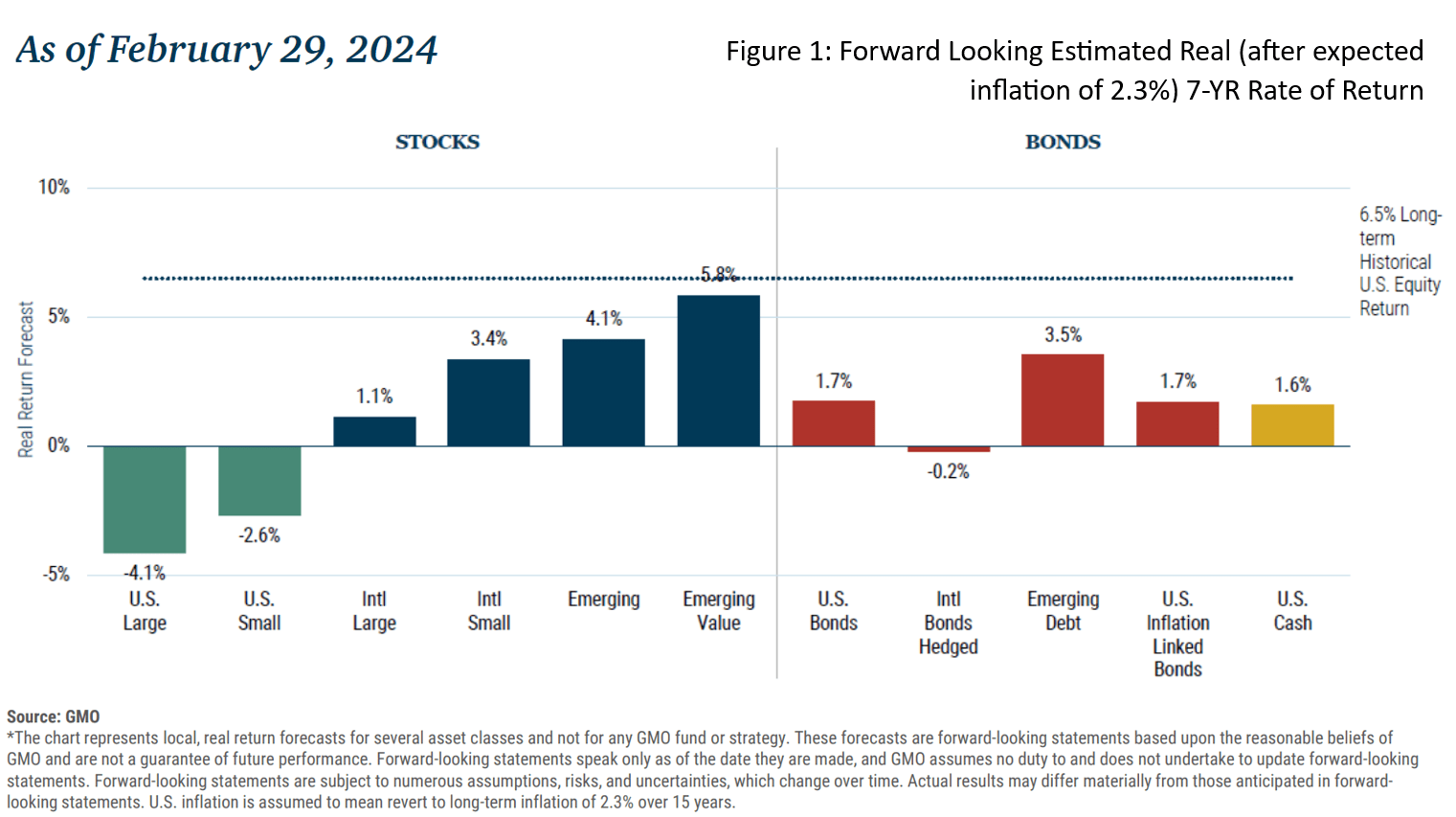

In Figure 1 below I have posted the 7-year net of inflation, forward looking return numbers from GMO, one of the best value managers in finance, and a firm that has alerted investors to every major pricing bubble since the 1970s. Their firm is not a perma-bear, but today they are not optimistic about the US equity market, especially US large company growth stock values over the near future. Trees don’t grow to the sky.

As you can see from the chart, US large and US small stocks (the 1st two green bars on the left) are negative – very negative after considering inflation at 2.3%/ year – which is less than it is today.

For the past 25 years, I have mostly tried to keep investors focused over the horizon and have coached clients to ignore short-term swings in markets, suffering through the Asian Financial Crisis, the Tech Meltdown, the Financial Crisis, Covid Lockdowns, and many more smaller stock market corrections. As with most old guys, I’m definitely more conservative today than I was at the beginning of my career, and I have a lot of grey hair to prove it. Because many of my clients are a few years older than me, many clients are now approaching retirement in the next 5-10 years, college payments or upcoming weddings. While there can be risk being out of equities if they rise, there are two ways to win in investing. Win by not losing and win by winning. I want everyone to really rethink their thoughts on risk and visualize how you would feel if the equity component of your portfolio value declined 30%-60%. Would a drop like this impact your ability to meet that goal confidently? If so, more defense or an alternative strategy that utilizes a more deviation from a long only index strategy might be worth looking into. We have already taken some risk off by rebalancing out of Investments that have grown faster than other areas of the market. I think the question we want to think about is have we reduced risk enough for you? Should we do more? Should we switch strategies even though what we have owned is well built and will be good in the future? Are there areas that we should continue to add more money to even if it is above the arbitrary limits we have set in the past?

For all of my career (except in 1997-1999), US large cap stocks which are widely owned have been priced to pay more than bonds. But today, because of the high valuations and recent gains, I’m afraid it is going to take 5-10 years to grow into these valuations. The major difference between stocks and bonds today is that stocks are very volatile, while bonds are pretty safe, especially over a 3-5 year time horizon. As many of you may remember from the COVID decline, we can always take safer money that is in bonds and switch it back to stocks a little at a time or all at once should valuations fall. I like to remind clients, that my conservative clients posted the highest returns in the financial crisis, because they had the dry powder to add to equities, whereas more aggressive clients were unwilling to borrow after suffering 40-50% declines and feeling like they had been punched in the gut. While I don’t believe in market timing, I view a possible change, like I’m considering, more of a way to reduce uncertainty, and to trade based proximity to your goals in a manner that creates the most confidence and certainty. For 50 years owning broad indexes with a long-term horizon has been a prudent high return way to invest, altering that strategy, to move to a more concentrated actively managed strategy even for a portion of the portfolio must be well thought out and clients must understand the tradeoffs of such a change.

What is the risk of being about ¼ more defensive than your current allocation or using active management in place of low-cost indexes?

#1 F.O.M.O. – The FEAR OF MISSING OUT. Envy is an extremely powerful force to fight, and it can sustain markets well beyond what seems rational. Timing markets is difficult and is a strategy I’m strongly against. If your neighbor stays invested in Nvidia and Tesla and this rally continues from one of the most expensive markets ever to an even more expensive, it can be gut wrenching to only make 5% while everyone is making 20%. If your horizon is long enough owning both offensive and defensive investments is a sure-fire way to have investment success.

#2 Taxes: For some investors to get enough funds to make a meaningful change we will likely have to realize some capital gains, something I try very hard to avoid, even if we assume a little more risk.

Let’s be clear, I’m usually not in favor of ever going 100% all in or 100% all out of any major class of investment, but given today’s high valuations, I do think today it a prudent time to be thinking, how much defense is the right amount? Should it be more than normal? Is it worth paying a little tax to be able to move to less risky investments? Generally, the market makes something cheap every day. Below Mr. Grantham says he believes Resource stocks that dig up metals and energy are pretty attractive, as well as Deeply Undervalued companies, like the US Small Company Value investment we own and the Emerging market value position we own (because of the geopolitical risk), and some Clean Energy companies. All of these businesses are usually perceived as riskier than buying the 50 largest companies in the S&P 500, but today because of the bifurcation in markets similar to other market bubbles “risky” may be “safer” and the “safer” may be risky?

As you will see below, I think there are more reasons to be cautious than to be aggressive with typical size weighted index funds.

Why I think caution is warranted in most US Stocks

Introduction to Why we may want to switch only equities to mostly long to cautious.

As markets have shot up recently, I have spent much of this quarter on the cost/benefit of adding an active management equity strategy to further diversify some market risk away from our prudent time-tested long-only index strategy. The great thing about the strategy we use is that it profits from known premiums available in stock prices, that have existed and appear to still exist in prices, that should be realized over the investment cycle to a more tactical strategy that selects fewer investments that meet the objectives of an actively managed stock-picker. Picking stock-pickers is very difficult task and investors should always remember that most managers selected will not be able to outperform the low-cost index strategy because of their fees and the taxes that must be paid on buying and selling stocks. It is impossible to know which managers are actually skilled vs just lucky until several decades have past, and by this time the managers that are skilled have been rewarded with large sums of money to manage making it much more difficult to outperform the low cost indexes we primarily use. (Note: in major market declines active management tends to hold up equal or better than index funds and in rising markets indexes tend to do better. Because markets rise twice as much as they fall, I have tended to favor indexes overactive management for a variety of reasons). Even Warren Buffet, the best stock-picker ever, reminded his shareholders in his most recent letter that his future returns would be much lower than his past returns because of Berkshire’s size which severely limits his investment choices. In reality we will always keep our primary strategy 1. Because it works 2. Because the embedded tax gains, makes it difficult to move away from. What is more likely is that we would use the 2nd strategy in retirement accounts or with new money that deviates from our low-cost method to gain additional diversification benefits and to attempt to better protect capital from today’s extremely high valuations.

- Insiders are selling large quantities of their stock: Some of the smartest investors in the world, insiders in their companies are taking major profits and selling their shares. Jamie Dimon (JP Morgan), Mark Zuckerberg (Meta), Peter Thiel (Legendary VC Investor in META, PayPal, and many others) are just a few of the insiders that have sold uncharacteristically large quantities of their shares. This is the first time Jamie Dimon has sold any shares in 10+ years. Historically, insiders have had great track records of selling near short-term market highs in their own stocks.

Below I have quoted in bullet point format quotes from 3 amazing investors that have a combined 15 decades of investment experience and while each has a different viewpoint, they are all 3 agree: now is a time to be cautious. I have included links to their websites should you want to read their entire article/shareholder letter or see additional information from these 3 wise investors.

Areas where all 3 investors agree:

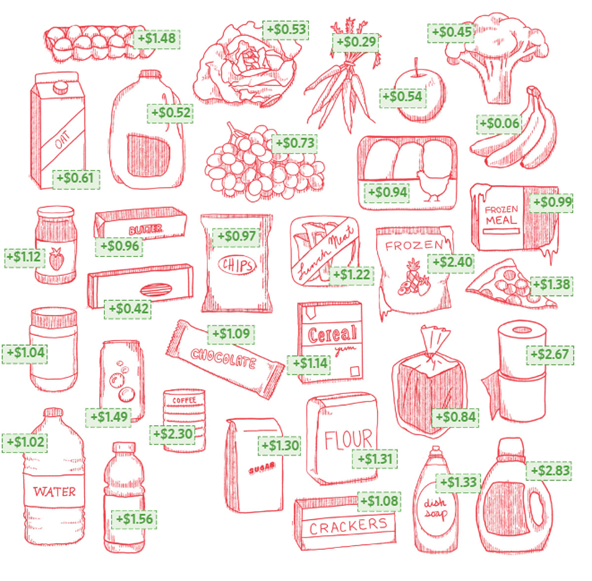

- The US economy has continued to be resilient as consumers have continued to spend money fueled by rising wages and government deficits. With the economy expecting a soft landing, anything that disrupts this narrative could create a risk for market prices.

- Geo-political tensions with China, and the 2 current wars. War, like the reshoring of supply chains, is inflationary and higher inflation could mean maintaining today’s higher interest rates for longer. (Because Wall Street has 3 rate cuts priced into today’s prices, if rate stay the same or rise this would effectively be an increase in what is expected and likely put pressure on stocks (higher interest rates usually mean lower stock prices.)

Jamie Dimon

James Dimon is an American billionaire the world’s most respected banker and business executive. He is the chairman and chief executive officer (CEO) of JP Morgan Chase, a Harvard MBA. His Shareholder letters are widely read and full of wisdom. His most recent shareholder letter was released on April 8th, 2024, and has a very cautious tone.

The Quotes below are from the JP Morgan Chase 2024 Annual Shareholder Letter

- “We may be entering one of the most treacherous geopolitical eras since World War II. And I have written in the past about high levels of debt, fiscal stimulus, ongoing deficit spending and the unknown effects of quantitative tightening (which I am more worried about than most)”

- “There seems to be a large number of persistent inflationary pressures, which may likely continue. All of the following factors appear to be inflationary: ongoing fiscal spending, remilitarization of the world, restructuring of global trade, capital needs of the new green economy, and possibly higher energy costs in the future (even though there currently is an oversupply of gas and plentiful spare capacity in oil) due to a lack of needed investment in the energy infrastructure.”

- “We are completely convinced the consequences will be extraordinary and possibly as transformational as some of the major technological inventions of the past several hundred years: Think the printing press, the steam engine, electricity, computing and the Internet, among others. Over time, we anticipate that our use of AI has the potential to augment virtually every job, as well as impact our workforce composition. It may reduce certain job categories or roles, but it may create others as well.”

- “Equity values, by most measures, are at the high end of the valuation range, and credit spreads are extremely tight. These markets seem to be pricing in at a 70% to 80% chance of a soft landing — modest growth along with declining inflation and interest rates. I believe the odds are a lot lower than that. In the meantime, there seems to be an enormous focus, too much so, on monthly inflation data and modest changes to interest rates. But the die may be cast — interest rates looking out a year or two may be predetermined by all of the factors I mentioned above. Small changes in interest rates today may have less impact on inflation in the future than many people believe.”

- “Therefore, we are prepared for a very broad range of interest rates, from 2% to 8% or even more, with equally wide-ranging economic outcomes — from strong economic growth with moderate inflation (in this case, higher interest rates would result from higher demand for capital) to a recession with inflation, i.e., stagflation. Economically, the worst-case scenario would be stagflation, which would not only come with higher interest rates but also with higher credit losses, lower business volumes and more difficult markets.”

- “There is too much emphasis on short-term, monthly data and too little on long-term trends and on what might happen in the future that would influence long-term outcomes. For example, today there is tremendous interest in monthly inflation data, although it seems to me that every long-term trend, I see increases in inflation relative to the last 20 years. Huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world and the restructuring of global trade — all are inflationary. I’m not sure models could pick this up. And you must use judgment if you want to evaluate impacts like these.”

- “The mini banking crisis of 2023 is over but beware of higher rates and recession — not just for banks but for the whole economy.”

- “If US long term rates rise to 6%: If long-end rates go up over 6% and this increase is accompanied by a recession, there will be plenty of stress — not just in the banking system but with leveraged companies and others. Remember, a simple 2 percentage point increase in rates essentially reduced the value of most financial assets by 20%, and certain real estate assets, specifically office real estate, may be worth even less due to the effects of recession and higher vacancies. Also remember that credit spreads tend to widen, sometimes dramatically, in a recession.”

Jeremy Grantham

Jeremy is a Co-Founder of GMO. Legendary Value Investor, famous for identifying all the major market bubbles of the past 50 years. He is once again sounding the warning signals like he did before the Nifty 50 stocks imploded in the 1970s, the Japanese stock market bubble burst in the early 1990s, the Tech bubble in the late 1990s, and the housing bubble in the late 2000s. Jeremy is a Harvard MBA, a Billionaire and when someone with his resume is pounding the table maybe we should listen or pay attention to his message.

The Quotes below taken from “The Great Paradox of the US Market”

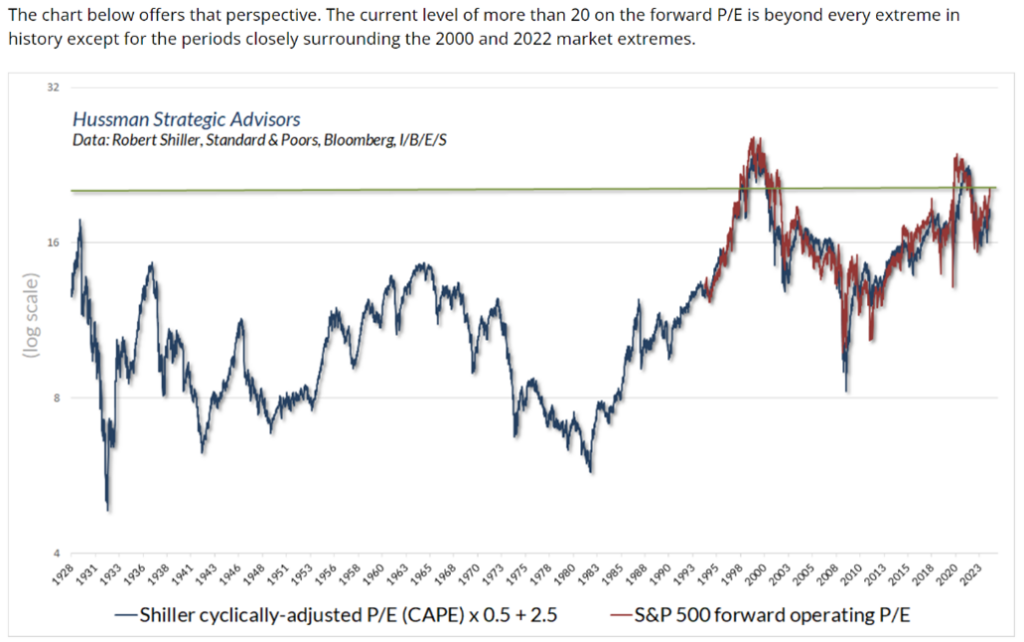

- “Well, the U.S. is really enjoying itself if you go by stock prices. A Shiller P/E of 34 (as of March 1st) is in the top 1% of history. Total profits (as a percent of almost anything) are at near-record levels as well. Remember, if margins and multiples are both at record levels at the same time, it really is double counting and double jeopardy – for waiting somewhere in the future is another July 1982 or March 2009 with simultaneous record low multiples and badly depressed margins.”

- But for those who must own U.S. stocks (most institutions) even when they are generally very overpriced, there is a reasonable choice of relatively attractive investments – relative, that is, to the broad U.S. market.”

- Resource equities: “Not only are raw materials finite – believe it or not! – getting scarcer, and therefore certain to rise in price, but at longer horizons (10 years) resources are the only sector of the stock market to be negatively correlated with the broad stock market. They are far and away the most diversifying sector (see Exhibit 1). They are also particularly cheap today having been whacked recently.”

- Climate-related investments: “With increasing climate damage and the increasing willingness of governments to take action, I believe climate investments will have top-line revenue growth that is guaranteed to be above average for the next many decades, although with no guarantees as to the smoothness of that growth. But, with all the cost of solar, wind, etc. being up front and little of the cost being operational, climate investments are exceptionally discount rate-sensitive, which has hammered them over the past two and a half years. And in its usual way, the market has overreacted to the trend of rising rates, making these investments real bargains today. Today, solar stocks are priced at over a 50% discount to the broad equity market, and some of the best clean energy companies in the world trade at levels that imply negative real growth.”

- Deep value: “These stocks look cheap enough to be worth some investment, as the comparison with the total market is about as wide as it ever gets. The most expensive 20% of U.S. stocks are by definition always expensive, but today they are in the worst 10% of their 40-year range (compared to the top 1000 stocks). In great contrast, the cheapest 20% are in the best 7% of their range.”

- On AI: “But every technological revolution like this – going back from the internet to telephones, railroads, or canals – has been accompanied by early massive hype and a stock market bubble as investors focus on the ultimate possibilities of the technology, pricing most of the very long-term potential immediately into current market prices. And many such revolutions are in the end often as transformative as those early investors could see and sometimes even more so – but only after a substantial period of disappointment during which the initial bubble bursts. Thus, as the most remarkable example of the tech bubble, Amazon led the speculative market, rising 21 times from the beginning of 1998 to its 1999 peak, only to decline by an almost inconceivable 92% from 2000 to 2002, before inheriting half the retail world!

- “So, it is likely to be with the current AI bubble. But a new bubble within a bubble like this, even one limited to a handful of stocks, is totally unprecedented, so looking at history books may have its limits. But even though, I admit, there is no clear historical analogy to this strange new beast, the best guess is still that this second investment bubble – in AI – will at least temporarily deflate and probably facilitate a more normal ending to the original bubble, which we paused in December 2022 to admire the AI stocks. It also seems likely that the after-effects of interest rate rises and the ridiculous speculation of 2020-2021 and now (November 2023 through today) will eventually end in a recession.”

- Mr. Grantham’s Coworkers at GMO, Ben Inker, head of asset allocation, and John Pease, Partner & quantitative researcher wrote a must read piece called “Magnificently Concentrated” that points out, “Since 1957, the 10 largest stocks in the S&P 500 have underperformed an equal-weighted index of the remaining 490 stocks by 2.4% per year. But the last decade has been a very notable departure from that trend, with the largest 10 outperforming by a massive 4.9% per year on average.” Data from 1957-2023 | Source: Compustat, Standard & Poor’s

- In this article Inker & Pease of GMO explain why owning the US Market as defined by the S&P500 might be more risky than normal with nearly half of the S&P 500 concentrated in just 7 stocks. In the past when a few stocks have made up a large percentage of the index, future returns were not as attractive. Maybe this time it is different, but historically that has been a poor bet. What will the future hold this time?

John Hussman, PhD

John Hussman, American philanthropist, economist, and hedge fund manager, Founder and President of Hussman Strategic Advisors. Mr. Hussman has an undergraduate and master’s degree from Northwestern, and PhD from Standford. Mr Hussman is a diligent researcher and writer. He has been sharing his views in papers for decades.

The Quotes Below are from Professor Hussman’s February 2024 paper titled “Cluster of Woe”.

- The potential for a near-term ‘air pocket’ or ‘free fall’ isn’t a forecast so much as a regularity that should not be ruled out. Even passive investors should examine their exposures carefully and rebalance their portfolios to reflect their actual level of risk tolerance.

- As for the U.S. market in general, there has never been a sustained rally starting from a 34 Shiller P/E. The only bull markets that continued up from levels like this were the last 18 months in Japan until 1989, and the U.S. tech bubble of 1998 and 1999, and we know how those ended. Separately, there has also never been a sustained rally starting from full employment.”

- The simple rule is you can’t get blood out of a stone. If you double the price of an asset, you halve its future return. The long-run prospects for the broad U.S. stock market here look as poor as almost any other time in history. (Again, a very rare exception was 1998-2000, which was followed by a lost decade and a half for stocks. And on some data, 1929, which was famously followed by the Great Depression.

- “Recall that the S&P 500 lagged Treasury bills from 1929-1947, 1966-1985, and 2000-2013. 50 years out of an 84-year period. When the investment horizon begins at extreme valuations, and doesn’t end at the same extremes, the retreat in valuations acts as a headwind that consumes the return that would otherwise be provided by dividends and growth in fundamentals.”– John P. Hussman, Ph.D., Return-Free Risk, January 2022

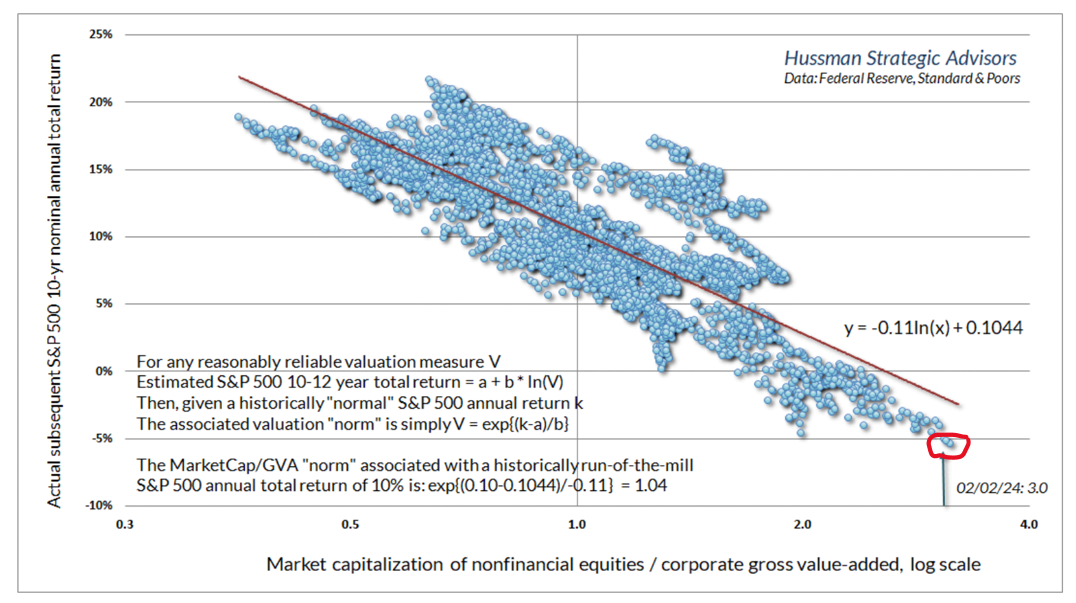

- “The only instances more extreme than today were 28 weeks surrounding the 2022 peak, and 5 weeks surrounding the 1929 market peak. The present extreme is about three times the valuation that has historically been associated with run-of-the-mill S&P 500 total returns averaging 10% annually.”

The red circled area highlights today’s Future Estimate at -5% (10-year Nominal ROR)

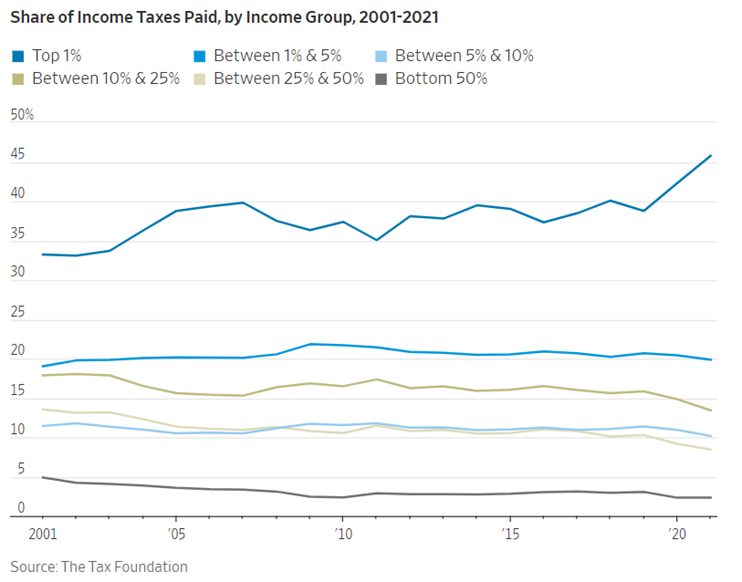

- “When investors look at current record profit margins and corporate free cash flow, they should recognize that this apparent prosperity is possible only because of massive deficits in the government sector, and depressed savings in the household sector in recent years. Sustaining one requires sustaining the other. Again, that’s not a theory, it’s just arithmetic.”

- The key point is simple: the “prosperity” of U.S. corporations here is the mirror image of massive government deficits and weak household savings.

- “Corporations have been the primary beneficiaries of both. The problem for investors is that maintaining deficits of this size is likely to prove unsustainable without a debt crisis.”

- “As for the stock market, the bottom line is this. We estimate that current market conditions now “cluster” among the worst 0.1% instances in history – more similar to major market peaks and dissimilar to major market lows than 99.9% of all post-war periods. Without making forecasts, it’s fair to say that we would not be surprised by a near-term market loss on the order of 10% or more in the S&P 500, nor would we be surprised by a full-cycle market loss on the order of 50-65%, nor a U.S. recession that the consensus seems to have ruled out.”

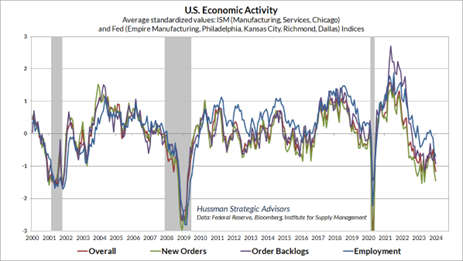

- “Amid the enthusiasm and now nearly unanimous consensus that recession risk is behind us, I’ll reiterate our own view: the data remain consistent with a U.S. economy at the borderline of recession, but we would need more evidence to expect that outcome with confidence. (4)

- The chart below shows our Economic Activity Composite based on regional and national purchasing managers and Fed surveys. After a brief pop in the fourth quarter, this composite has again turned lower, and is already at levels that have historically been consistent with emerging recession.”

- My impression is that investors feel an almost excruciating “fear of missing out” amid nominal record highs in the S&P 500 and Nasdaq 100, enthusiasm about an economic “soft landing,” and an expected “pivot” to lower interest rates. In my view, abandoning systematic investment discipline amid the most extreme market conditions in history would be a costly way to buy a fleeting sigh of relief.

Conclusion

Wow, reading those 3 in a row is a buzzkill. Let’s say I agree with the experts’ thought process, and I want less risk in my portfolio. With the bifurcation that exists between the biggest companies in the US compared to the others, how would we further change or implement some of the ideas above into your portfolio? There are many ways we could accomplish additional risk reduction. One way is to add active management managers with concentrated portfolios that look nothing like the indexes. The easiest way is to purchase or lock in fixed income returns when we can get intermediate or longer dated bonds around 5% yields (or higher). We have already locked in intermediate yields of 4.5%. (if there was a correction in equities it is probable rates would decline further and add to fixed income yields). To add more fixed income than we have today, investors must be comfortable with lower short-term returns, no matter what equity markets deliver. This shift in mindset can be difficult. We can also incorporate additional diversification strategies that behave differently than long-only portfolios, like the ones Mr. Grantham mentioned. For most investors that have taxable money outside of IRAs and retirement plans, adding more defenses will require taxes to be paid and must be weighed. I want to restate the portfolio strategy we have today is very good and is already tilted away from the overvaluation in the major indexes. The million-dollar question is always is the risk vs return comfortable for your plan? If I’m ever going to make a shift in strategy, I want to do it while we are fliting with highs, even if I leave a little on the table.

A question for you to ponder: After a large run up in prices should you adjust the risk in your portfolio more than the systematic rebalancing that MWA has already completed or are you ok keeping your eyes 5-10 years over the horizon and just sitting tight and riding out the volatility? Most of the time we think this is the best strategy, especially if the portfolio already has high quality defense in it. It should be noted for clients in the withdrawal phase even with 40%-50% in defense after rebalancing and withdrawals portfolios will approach 80-90% equites in severe bear markets. This is nice to understand in advance.

Markets are complex systems and there are lots going on. There are always both positives and negatives to digest and for every seller there is a buyer. What I am most worried about is the prior Government stimulus, where we are borrowing from the future and loading our kids up with debt that somebody will need to repay or slowly inflate away through money printing, which will slow down or stop. When this is removed will the economy be running fast enough to make up the difference?

Two positives are we are still an undersupply of housing. The peak of the baby boomer kid’s kids is finally buying homes, and because supply is basically 10 years behind as a result of the financial crisis, we have a lot of catching up to do. Building houses is a positive for the economy, it employs lots of trades. This is just one reason we don’t expect a large economic slowdown and why we think inflation will not get back to the FED’s 2% target. I think it is more likely they adjust their target upwards or change their current rate cut narrative. The other long-term positive for equity valuations is the effects of technology on profits and interest rates. Driverless technology and AI are just two of many that should eventually be deflationary and counter the inflation we are currently experiencing.

If rates rise enough or stay high long enough the economy will slow, but many more seasoned investors have reminded me that 4.5%-5% are not low rates, these rates are right in the middle of long-term average rates, it’s just that most of us may have not experienced 6-8% borrowing rates for several decades.

The theme of this message is the future is uncertain. I want to triple check that I have you are 100% on board with the strategy we are implementing. We do not want to be the cause of any future sleepless nights. Until my next letter in the heat of Summer, enjoy your Spring and thanks for letting us help you and your family.

All the Best,

–Mike

Tax Corner – Estate Tax Sunset

The estate tax limit is set to sunset in 2026 due to specific provisions embedded in the Tax Cuts and Jobs Act (TCJA) of 2017, a comprehensive overhaul of the U.S. tax code signed into law under the Trump administration. The TCJA included significant temporary changes to the estate tax, most notably doubling the exemption limits. Prior to the enactment of the TCJA, the estate tax exemption was $5.49 million per individual, subject to adjustments for inflation. The TCJA raised this exemption to approximately $11.18 million for individuals and $22.36 million for married couples, also indexed to inflation.

This dramatic increase in the exemption threshold meant that fewer estates would be subject to the estate tax, effectively reducing the tax burden for high-net-worth individuals and families. However, these changes were not made permanent. They were set to expire after 2025, reverting to pre-2018 levels adjusted for inflation. This “sunset” provision was strategically included to help manage the federal deficit projections and comply with the Byrd Rule, which restricts certain types of legislation that might significantly increase the federal deficit beyond a ten-year term under a reconciliation process. Reconciliation allows the Senate to pass budget-related bills with a simple majority, bypassing the usual 60-vote requirement needed to overcome a filibuster.

Thus, the sunset of the increased estate tax limits was a fiscal strategy, aiming to make the tax cuts more palatable to budget hawks and critical for passing the TCJA through the reconciliation process without broader bipartisan support. After 2025, unless new legislation is enacted to extend or permanently adopt the higher exemption levels, the estate tax will revert, impacting estate planning and taxation for estates exceeding the pre-TCJA thresholds.

Currently the individual estate tax exemption is $13.61 million, and for couples $27.22 million. It is likely that when the sunset occurs, this will lower the individual exemption to somewhere in the ballpark of $7 million, and the couple’s exemption to around $14 million.

Whether sunset occurs or not is heavily dependent on who controls congress, the senate, and who is in the White House come 2025. This is an important detail for many of you and expect to hear more from us about it later this year, and especially early next year. We anticipate that if changes are not made to the sunset, that estate attorneys will be busy in 2025 making changes to people’s estate to take advantage of the higher limits. So don’t be surprised if we suggest meeting with an estate attorney in late 2024 or early 2025 to make sure we take advantage of the higher amount. For more information read this article that we wrote last year about it.

Around the MWA Office

With Tax Day behind us you or your CPA will be hearing from us soon to gather your 2023 tax return. We understand that many of you may have filed an extension. It is important for us to analyze your tax return, not to replace or supersede your account, but to make sure that we are using all of the available tax benefits available to you. As your financial advisor, it’s important for us to get the full picture of your finances to give you the best advice possible. Your tax return is helpful because it lays out all your income, investments, and deductions in detail. This lets us customize our advice to fit exactly what you need and what you’re aiming for. Knowing your tax bracket and financial history allows us to spot smart, tax-saving strategies and other opportunities that you might not be using yet. By sharing your tax returns with us, you’re giving us the information to help you make the most of your financial planning and achieve your goals more effectively. If you are able to, Click Here to upload your 2023 tax return now.

In addition to this, you may have seen on LinkedIn that we are currently looking for a receptionist/client service admin. As we continue to grow as a company our service needs grow with them, and we anticipate we may need to hire a new employee almost every year. If you know anyone who you think would be a great addition to our team, please let us know, we would love to talk with them and see if they would be a good fit. You as clients are the most important part of our job and we want to be sure to continue to give the best service possible.

Thank you for your continued trust in us. If you are feeling any sort of anxiety or uneasiness about your current situation, please reach out to us to schedule time to talk and make any necessary adjustments to help you reach your goals.

Pictures Worth Looking At