In our last Quarterly Newsletter, we focused much of our time and attention on what happened in early April with the tariffs and the postponement of the tariffs. So, just like the market ignored that and pressed onward and upward, we will only lightly discuss the beginning of the 2nd quarter, then shift our focus to be more on what transpired in May, June, and what we see for the next quarter as we enter July.

We came into 2025 expecting there to be much upheaval and changes. We have not been disappointed in that regard. Many things have changed in the first 6 months of the year, but the one thing that has stayed the same is much of the uncertainty that we have felt since the beginning of the 2020s.

SECTION I – QUARTERLY MARKET REVIEW

SECTION II – MIKE’S COMMENTARY, QUESTIONS, AND QUOTES

SECTION III – TAX CORNER – THE BIG BEAUTIFUL BILL

SECTION IV – AROUND THE MWA OFFICE

SECTION V – PICTURES WORTH LOOKING AT

Quarterly Market Review

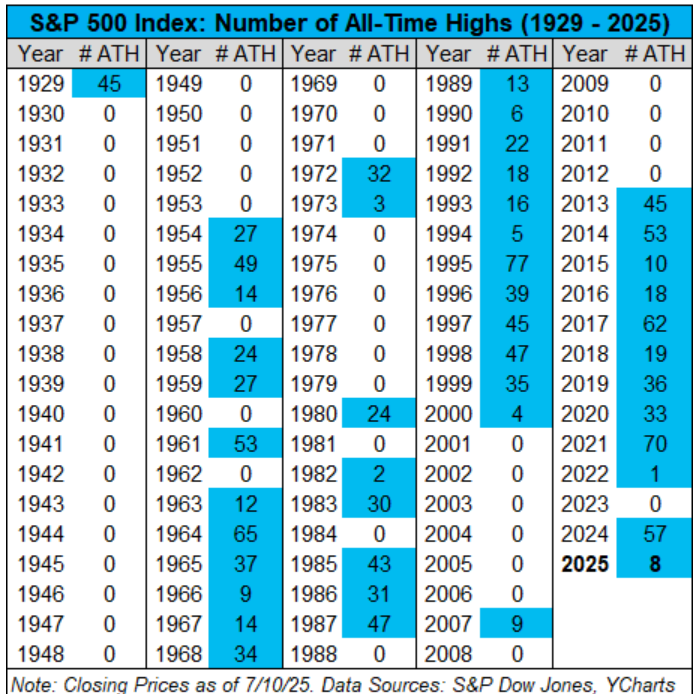

The second quarter started out rocky with an over 10% drop in all major markets due to tariffs posed by the USA in the first 2 weeks. Luckily, the tariffs were paused and the markets quickly recovered. International Developed Stocks led the way with a return of 12.05%, followed closely by Emerging Market Stocks at 11.99%. Meanwhile, the U.S. Stock Market had a return of 10.99%, while Global Real Estate came in at 2.74%. The Global Bond Market ex U.S. grew 1.93%, and the U.S. Bond Market landed at 1.21%. Even more encouraging, all these markets have shown positive returns over the past 1-, 5- (except US Bond Market) , and 10-years. To view the full Market Review Deck, CLICK HERE.

Mike’s Commentary, Questions, and Quotes

I’m very happy with our portfolio returns so far this year because diversification has finally worked again. Many of you know my formative years in the investment business occurred at the very end of the Tech bubble, and the 10 years following it, as the market busted wide open. The S&P500 had a negative return over that decade, while the portfolio that owned a broader range of Global stocks posted returns closer to 6-9% – depending on the exact holdings and weightings.

I think the lesson I learned was that diversification is the only “free lunch” when investing. The farther you go back in history, the more you realize money eventually moves toward the best relative values. All assets will eventually revert toward their long-term average returns. Whenever one area of the market wins for an extended period, wise investors will continue to use past strength to rebalance some gains toward less expensive areas that will eventually become tomorrow’s winners. We still think holding US value across sizes makes sense. We have held our international and emerging weightings as well. They are slightly lower because the extra money added to the US has rebounded higher. We don’t believe we can predict who will win in the short run, but in long-run markets work like a weighing machine.

We will continue to use your goals and your financial plan’s funding relative to those goals as a barometer to help us guide you toward prudent portfolio decision making, so we know when we should step on the gas and when to recommend reducing your speed. Our goal is to make sure we avoid collisions, so achieving your goals occurs with a high confidence of success.

US equity markets still make up the largest positions in our portfolios. We added money to US Equity in April when markets fell on the fears caused by Trump’s new tariff policy. The quick 20% off sale gave us an attractive entry point to deploy more capital into US markets when they were on sale. The recent decline seems to be ancient history and well in the rearview mirror, even though the impact from these new policies have not yet had time to make it into the economic data yet. Many analysts expect corporate earnings to slow down, but think a recession is probably not in the current cards. We are keeping an eye on consumer spending because it makes up about 70% of GDP.

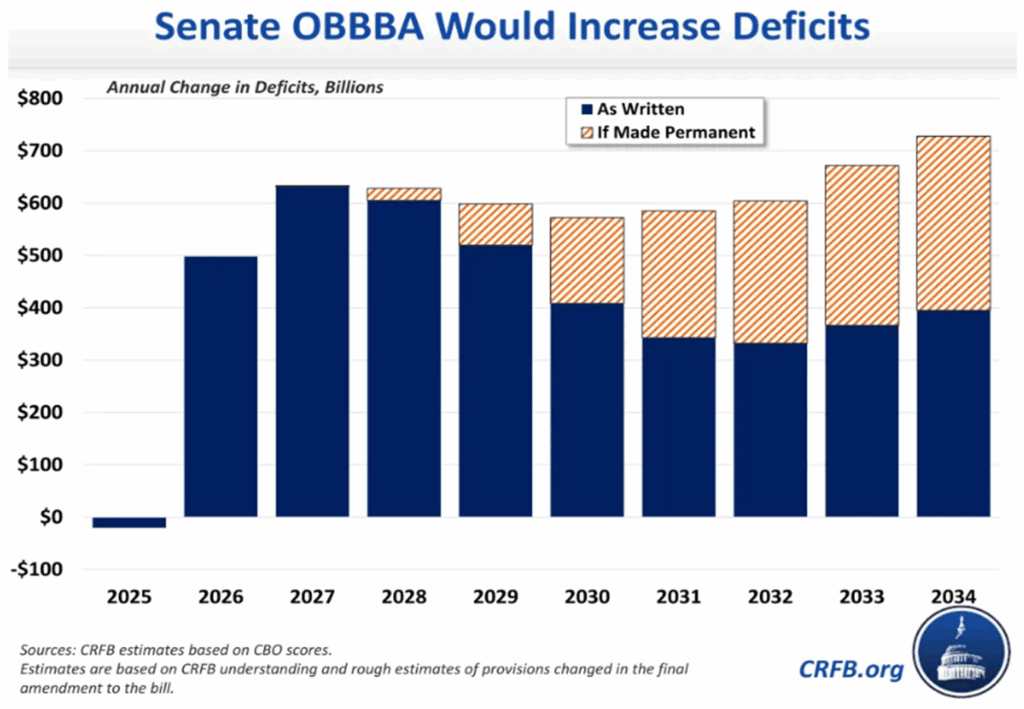

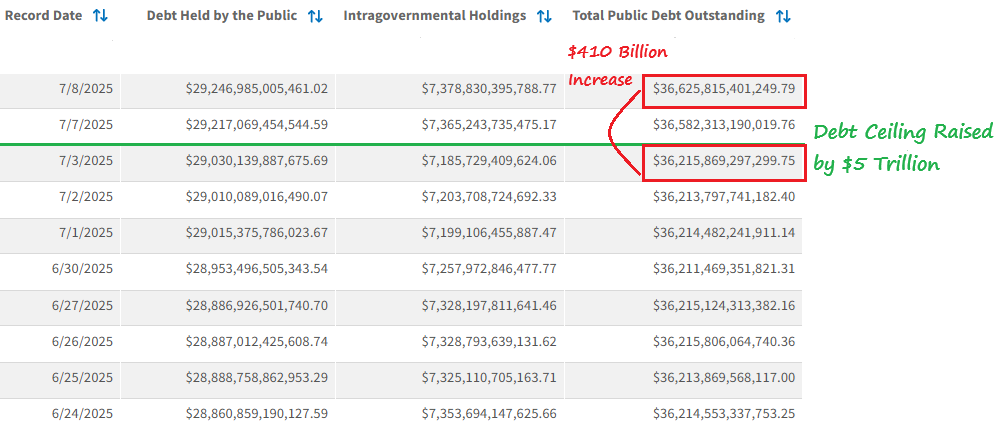

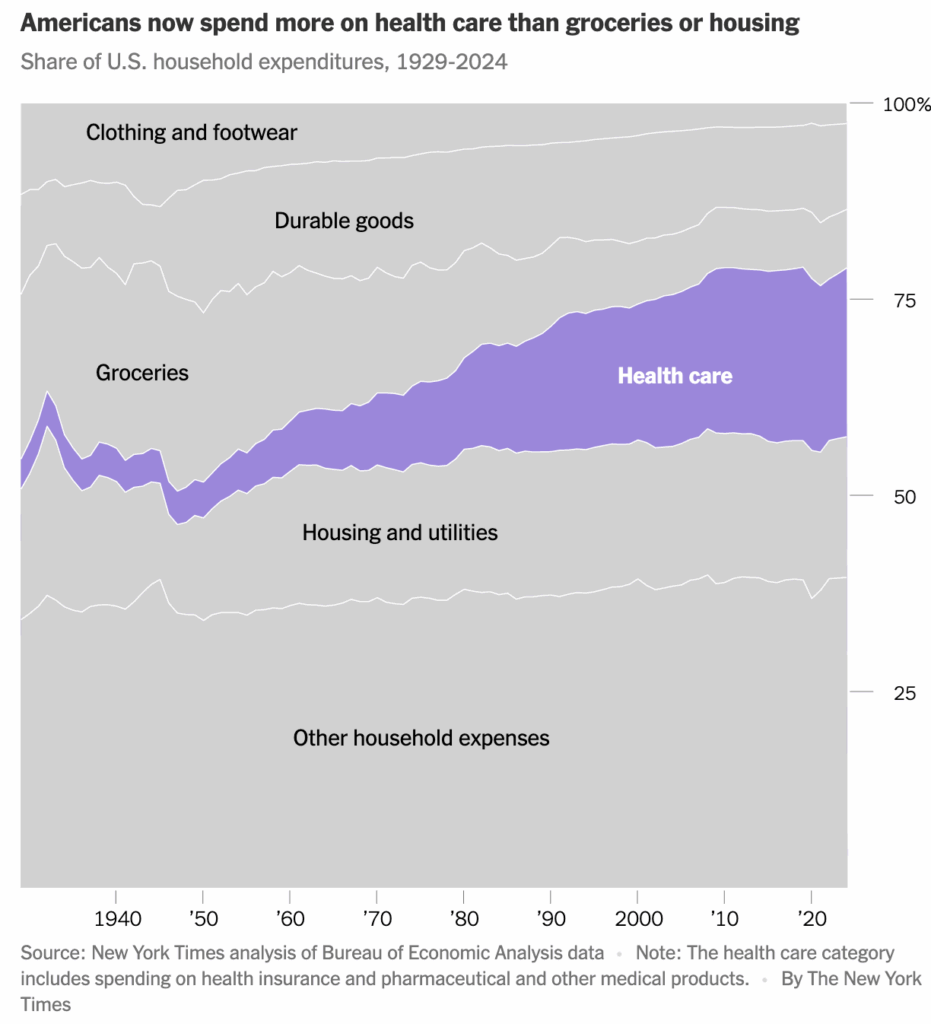

Working class Americans appear financially stretched. Credit card debt is rising, housing is more expensive, and tariff related inflation is felt more by Americans that must spend a greater percentage of their paychecks. With the passage of the Big Beautiful Bill, most Americans will get some tax relief, but the government will continue to spend more than it makes. Moody’s downgraded the United States’ credit rating from AAA to Aa1. This downgrade announced May 16th, 2025, caused Treasury yields to rise slightly and led to a decline in the dollar. US Treasurys are still the safest asset in the world, since our government owns a printing press and all the borrowing are in US dollars, but in the past when previous Empire’s choose to print money vs managing their fiscal house it weakened their economic power (and they are not the reserve currency today). America still has many assets that can be monetized, but it is important that we keep our fiscal house in order. The longer we wait the harder the choices become.

Interest rates rose slightly during the quarter but are still range bound. If intermediate-term bond rates rise above 4.5% (5.5% on longer-term debt), we will reposition some of our shorter-term holdings into longer duration debt seeking to push our average yields out to 7-10 years because longer dated debt typically offers investors more defense in equity sell-offs. Today, municipal debt is more attractively priced than corporate debt for investors in the 22% tax bracket and higher. Municipalities are also in stronger financial position than they have been, making “munis” a good relative value especially for investors in higher tax brackets. (5)

Financial Planning Strategy:

When possible, we are still favor paying down debt when interest rates are greater than 6% over holding most bonds especially in taxable accounts.

Inflation/Deflation?

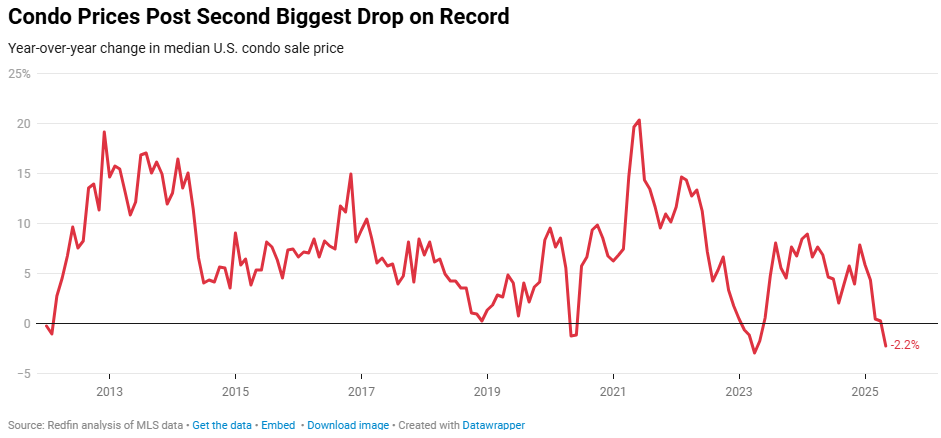

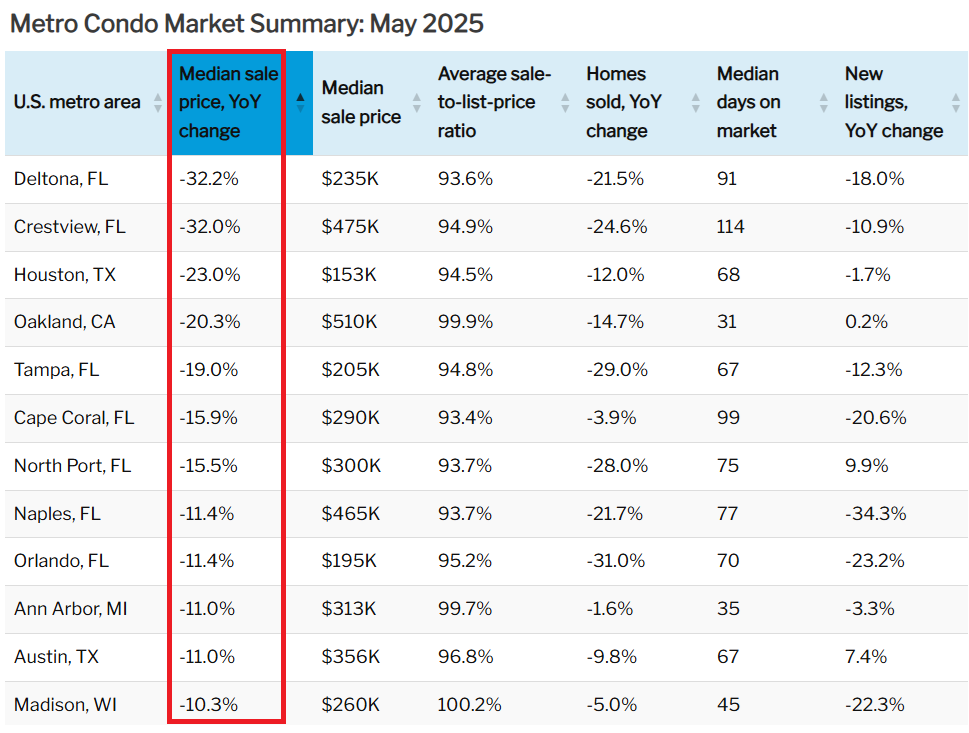

Since the industrial revolution the world has mostly experienced inflationary forces. The big exception to this was the great depression and housing prices during the Financial Crisis. I think economists learned that having some inflation is easier to control than out of control deflation. For investors, the game-plan for a deflationary environment is different than one where we expect inflation.

Litman Gregory, one of my favorite market strategists had this to say regarding inflation and its effects on the US interest rate picture, “Our view is that inflation, from a structural perspective, remains under control. For example, the Consumer Price Index (CPI) ex-shelter, has been below the Fed’s 2% target in 19 of the past 24 months, underscoring the disinflationary trend in much of the economy.” I think this disinflation trend has come from several factors. The biggest factor has been the productivity unleased from technological advancement. Just think of the jobs that may be replaced by driverless technologies and other AI. I think AI has the potential to be more detrimental to US jobs than the effect outsourcing jobs to lower cost areas of the world.

Two other deflationary forces are the large US deficits, and lower birthrates. One of the reasons inflation has remained under control for so long is worker wages have risen slower than most prices have risen. This has caused the divide between rich and poor to widen, as CEO pay is up over 10x as profits have risen from controlling labor cost and cheaper supply chains.

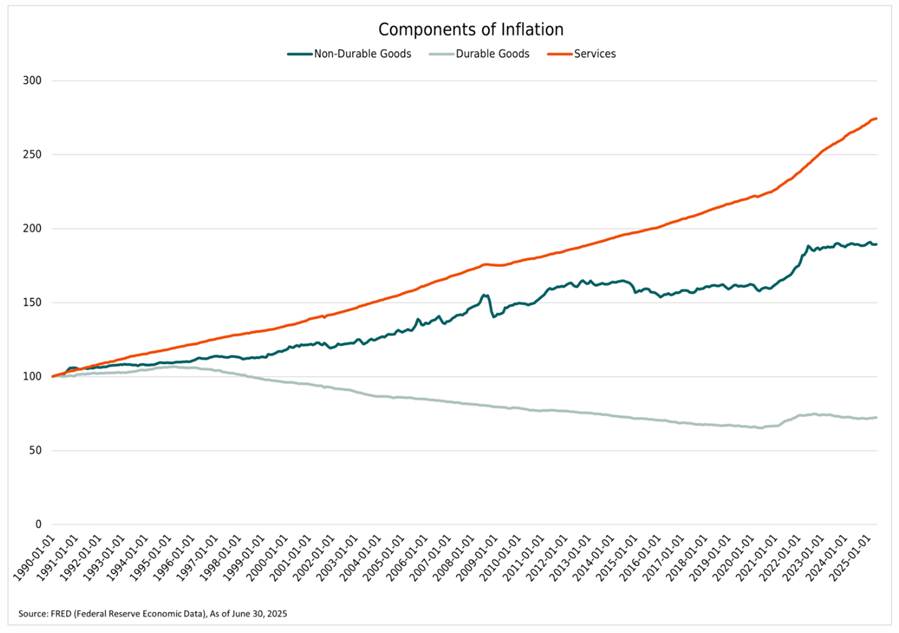

When Litman Gregory broke down the components of inflation (as shown in the chart below), “the only area that has been showing inflation is services, specifically shelter. In contrast, both durable and nondurable goods have been flat to deflationary since 2022. While upcoming tariffs may temporarily push inflation higher, the Fed is likely to look through these shorter-term effects and focus on the underlying structural picture, which we think remains benign.” (2)

Historically when inflation is declining, stocks normally do well. Many investors have been cautious thinking tariffs are likely to cause some additional inflation and a recession. The market has chosen to look past these short-term declines in earnings (which should start to show up next quarter). Economic activity has remained strong as the threat of tariffs caused some pre-buying. It will be interesting to see if the market gives back any of these recent gains.

At Mills Wealth we are sticking with broad diversification and will maintain exposure toward undervalued assets. We will continue to hold onto our high profit companies and maintain less exposure to low profit companies. We have seen bitcoin rebound and gold continue its march higher. So far it is up 30% on worries about money printing. The reality is because The US Government is borrowing in US dollars (which can be printed at will) The US will not default, but if we take the easy way out and print money (compared to controlling our spending) it is likely the long end of the yield curve could rise over the near term if foreigners stop buying or slow down purchasing Treasuries and other US assets.

It is also possible the dollar could continue to fall, making overseas assets rise in dollar terms. A declining dollar would make overseas assets more expensive in dollars which could be inflationary. So far, the tariff policy has shaved off about 17% off the dollar’s value. If you travel overseas this summer you may notice the dollar is not as powerful as it was a year ago, however meals in Portugal are much cheaper than meals in NY City, so the dollar is still strong by comparison.

This is still a good time to maintain overseas asset exposure. We think international stocks look very attractive especially in areas that will be affected by Germany’s deficit spending plan as well as in Japan. Many companies in Japan still trade below their book value and while they may not rise overnight, I think you will find many of their companies will not fall near as much if US markets were to catch a cold.

What else might cause inflation to rise? Reshoring supply chains require large capital investments and is generally viewed as inflationary.

Fed officials expect unemployment to rise to 4.5% this year (from 4%) and settle at 4.4% in 2027. Wage growth remains above pre-pandemic trends but has decelerated,

Private Credit Discussion:

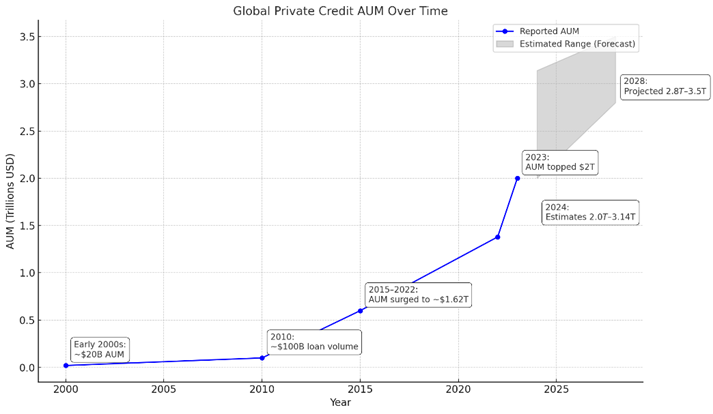

The 2025 BlackRock Family Office Survey shows a third of its respondents wanted to increase their allocations to private credit, the highest of any asset class. (3) Over the past 12 months we have spent quite a bit of time attending private credit conferences and meeting private credit wholesalers. So far, we have opted to avoid allocating new funds to Private Credit (although we like private credit more than private equity). Why? Private Equity is expensive after years of strong asset flows and valuations are high. This will make it hard for private equity investors to win in aggregate and justify the long lock ups and ill-liquidity.

Anytime too many people get on one side of the boat in investing, future returns will look different than past returns (usually much lower). In private credit markets over the last 3 years, massive amounts of money have flowed into this once niche area of the markets. Private credit used to offer returns net of fees between 9-12%, going forward I bet you will be lucky to see returns north of 6% (Not a bad return, but not worth the ill-liquidity risk of not being able to easily move your funds to a better sandbox if conditions change.

“Family offices represent a vast pool of capital — around $3.1 trillion globally as of 2024 — and are increasingly seeking new sources of returns as private equity distributions slow. Private credit, unlike PE, doesn’t rely on an exit to return money, but rather, throws cash off regularly through quarterly or even monthly interest payments. The burgeoning $1.6 trillion asset class is expanding its sources of cash as traditional buyers, including pension funds and endowments, become fully allocated to the sector.”

Now they are trying to get offerings into retail brokers and 401k retirement plans. Wall Street will hawk past returns and sophisticated “smart” managers, but these partially liquid high-cost vehicles must be evaluated carefully. You don’t want to be the last person on the bus. Plus, you really need someone to understand what they are buying as future risk might look different than in the past. There is power in being able to sell or change your investment if the environment changes. Many of the private credit investments lock up money for over a decade. To accept this illiquidity Investors should demand a large premium over publicly traded assets. Investors must continually guard against FOMO and a good sales pitch.

“Right now, advisors allocate an average of just 5% of clients’ portfolios to alternatives, compared with 25% by institutions, according to Fidelity. Part of the gap is due to limited access, since private markets are typically restricted to accredited investors. But unfamiliarity also plays a big role. Private markets are complicated territory.” (3) Private markets also come with lower liquidity, less transparency, and complex fee structures“(3)

“Private Credit has swallowed up a lot of the fast-and-loose loan and debt origination that was done by banks pre-2008,” he told Advisor Upside. “Now, these Private Credit funds are being shoved into portfolios left and right, and it comes with a lot of unevaluated risks that people aren’t realizing.” (3)

Alan Waxman, CEO of investment firm Sixth Street, says publicly traded rivals such as Apollo Global Management and Blackstone have reoriented their credit businesses to take in huge sums of money from insurance companies and individual investors. That means money flows in and must be put to work quickly, whether or not the investment opportunity is ripe.

The 50-year-old Waxman, who in 2000 created one of the first private-lending businesses while at Goldman Sachs, isn’t predicting this will end with a blowup. Instead, he argues these firms are turning private credit from a bespoke type of investing with relatively high returns into a commoditized, lower-returning business. His rivals, Waxman says, have become factories, churning out deals with little consideration for their long-term prospects.

Waxman’s warnings come at a sensitive time. Some institutional investors are already starting to complain private credit isn’t living up to its prior gains. And regulators are evaluating ways to make it easier for 401(k) investors to participate in private markets.

The firm’s publicly traded direct lending arm has returned a net 13.3% including dividends since inception, as of May, versus an average of 7.3% for public peers. It also charges higher fees than newer nontraded peers that have been created to raise money from individuals. In direct lending, for example, Sixth Street has remained active when rivals have retreated during periods of volatility, such as after the rapid rise in interest rates in 2022. It is now more cautious, arguing rivals with billions of dollars from individuals are rushing to put money into deals.

Co-Chief Investment Officer Josh Easterly warned in an April letter to shareholders of Sixth Street’s publicly traded lending arm that rivals would only be earning about a 5% return on equity—not much higher than what a certificate of deposit pays. Some rivals dispute his math. As Waxman often says: “Just because you can raise the capital doesn’t mean you should.” (4)

Please don’t hesitate to call or text or email with any questions you might have.

All the Best,

–Mike

Sources

1 https://www.gmo.com/americas/research-library/the-quality-anomaly_gmoquarterlyletter/

2. Litman Gregory https://lgam.com/second-quarter-2025-investment-commentary/

3. Advisor Perspectives https://www.advisorperspectives.com/articles/2025/07/12/private-credit-ultra-rich-3-1-trillion Private Credit Lures the Ultra-Rich Sitting on $3.1 Trillion by Kat Hidalgo of Bloomberg News, 7/12/25

4.WSJ “A Pioneer in Private Credit Warns the Industry Is Ruining Its Golden Era

-Sixth Street’s Alan Waxman says his publicly traded rivals are turning private credit into a commoditized business—and he isn’t following suit” Miriam Gottfried 6-29-25 5. Schwab.com: “Municipal Bonds: Mid-Year 2025 Outlook” Cooper Howard 6-27-25

Tax Corner – The Big Beautiful Bill

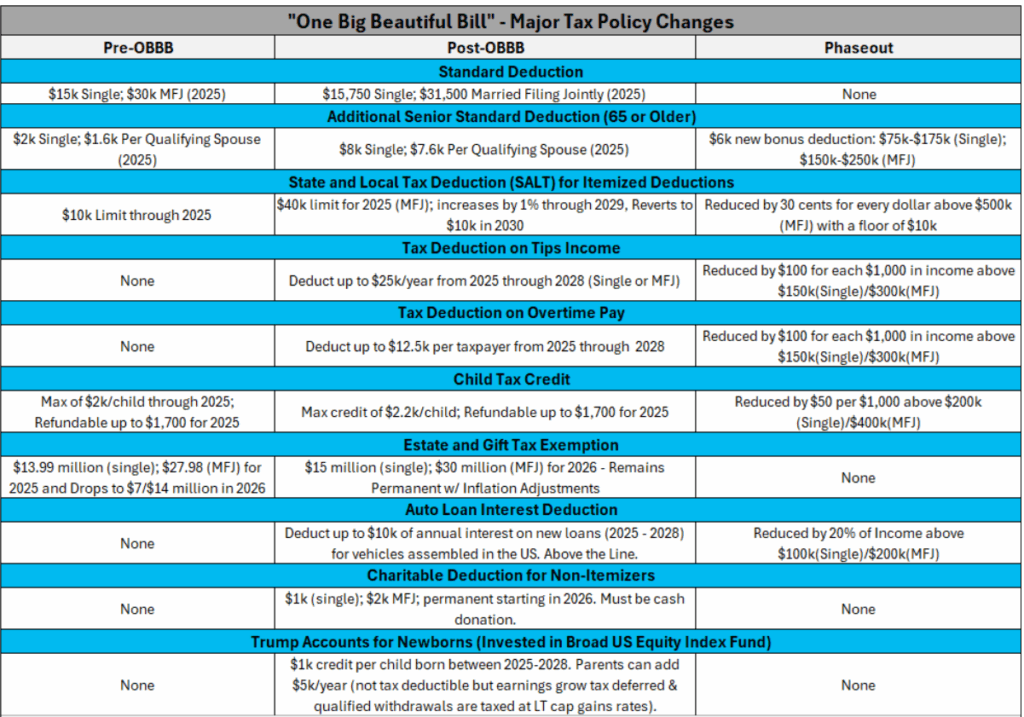

Congress recently passed sweeping tax legislation known as the “Big Beautiful Bill.” This law brings several important changes that will impact business owners, high-net-worth families, and anyone with a complex tax situation.

First, the bill permanently raises the federal estate and gift tax exemption to $15 million per person (or $30 million for married couples). This change, found in Section 70106, adjusts for inflation and allows more room for tax-free wealth transfers. Families with estate plans or gifting strategies should revisit them to take advantage of this new limit.

Second, the bill restores billions in IRS funding. These funds will help the IRS hire more auditors, upgrade outdated technology, and improve enforcement. The funding appears in the appropriations section of the bill, and it signals a renewed focus on audits, especially for high earners and business entities.

Third, the IRS will increase oversight of aggressive tax strategies. While not tied to a single section, the bill’s enforcement goals are clear. Areas like inflated valuation discounts, questionable conservation easements, and complex trust structures are more likely to face audit.

Finally, the bill expands the Qualified Small Business Stock (QSBS) exclusion, increasing the ability to exclude gains on certain business sales from federal tax. This change makes early-stage investing and ownership in small businesses even more attractive for entrepreneurs and investors. We’ll share a deeper breakdown in the coming weeks. Stay tuned.

Around the MWA Office

Now that tax day has come and gone we have requested tax returns to analyze and use in our planning services. At times you may wonder why your financial advisor needs your tax return. Here are a few of the reasons why we would want it.

- Find Tax Savings

Helps spot missed deductions, credits, and strategies like Roth conversions or charitable giving. - See All Income Sources

Shows W-2s, 1099s, business income, dividends, and Social Security. - Know Your Tax Bracket

Guides decisions on withdrawals, conversions, and timing income. - Coordinate With Your CPA

Keeps your financial and tax strategies aligned. - Place Investments Smarter

Helps decide what belongs in taxable vs. tax-deferred accounts. - Plan Retirement Income

Helps avoid surprises with RMDs, pensions, and portfolio withdrawals. - Manage Capital Gains

Improves tax-loss harvesting and gain realization decisions. - Support Business Planning

Shows us how your business is taxed and how to plan around it. - Track Year-to-Year Changes

Reveals shifts in income, deductions, or strategy needs. - Confirm the Full Picture

Verifies what’s been filed matches what’s been discussed.

We understand that you may have filed an extension, and we can wait until the extension day to get your return. But, if you have filed your 2024 tax return and haven’t sent it to us for review yet, feel free to Click Here and upload it.

Pictures Worth Looking At