Young professionals have one major advantage in building wealth: time. Starting to invest early creates long-term momentum. It gives investments the chance to grow steadily before major life expenses begin to compete for attention.

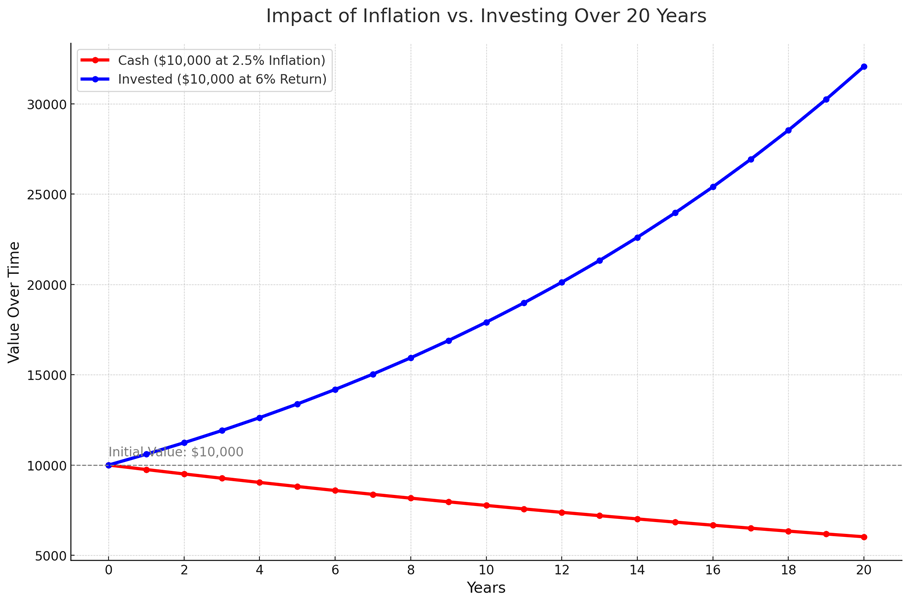

Cash sitting in a checking account loses value. Investments, when managed wisely, have the potential to compound. This effect becomes more powerful the longer the money stays invested. Starting small, with consistent contributions, can lead to strong financial outcomes over time. This graph shows how cash left alone will lose value, versus putting the same amount of money into the market.

A financial advisor helps prevent common mistakes. Some young investors take on too much risk. Others are too conservative. Without guidance, people may overlook taxes, withdraw at the wrong time, or follow short-term market trends. A financial plan tailored to income, lifestyle, and goals helps provide direction.

Planning also helps with prioritization. Many young clients want to invest but aren’t sure how to balance that with debt payments, short-term savings, or future purchases. Questions about Roth IRAs, 401(k) contributions, and high-yield savings accounts often come up early. These decisions benefit from context and clarity.

Beginning early builds consistent habits. Tracking spending, investing regularly, and reviewing goals over time creates structure. It also makes it easier to stay calm when markets change or personal circumstances shift.

A strong foundation built in the first few working years provides more freedom later. Buying a home, starting a family, or launching a business becomes more manageable when savings and investments are already in place. Investment success comes from long-term consistency, not

The longer you wait to invest, the more you give up in potential growth. Getting started early doesn’t require perfect timing or a large sum of money. It just takes consistency and a plan. Over time, small steps can lead to meaningful results. Starting now puts you in a better position to reach your goals and respond to life’s opportunities with confidence.