Happy new year! As we enter 2024, I want to cover a few key concepts that are deeply embedded into how Mills Wealth thinks about protecting and growing your portfolio in a manner that offers investors a very high probability of success. Investing is a risky business, there are no free lunches, at MWA, we want to mitigate or reduce as much risk as possible, to allow our clients to achieve their goal – no matter what scenarios unfold in the future.

Diversification and long-term thinking can both reduce risk, but one thing to remember when you diversify is there is a tradeoff that a few positions in the portfolio should always be losing. This is a key component of eventually winning no matter what happens in the future. When a market (like the NASDAQs of the world) rises faster than a diversified portfolio, it is human nature to feel FOMO or regret. Should you have these feelings, please reach out and have a conversation about this topic, because this is one of the jobs of having a financial advisor on retainer. I can promise you that you are not the first investor to feel these emotions or feelings.

Thinking long-term: Most investors will not spend 100% of their saved money tomorrow, nor in 10 years; instead, it will be much longer than that. Even at retirement, very few clients spend the money they saved all at once in a lump sum; instead, it is more likely you spend it in pieces over decades according to your withdrawal plan. By leveraging this known, we want to choose investments in your portfolio that will have the highest returns before we need to spend the money, not what has had the highest returns in the past or today. Almost all the investments we choose are looking 5-10 years into the future. We don’t know when they will profit, only that it is likely they will eventually achieve their average. I hope the following pages will help you see the horizon as we are trying to.

Quarterly Market Review

The 4th quarter was quite the rollercoaster ride. The first month saw the market move down quite a bit, only to be followed by one of the best Novembers EVER recorded. Both Bond and Stock Markets across the world were sharply up in the 4th Quarter with Global Real Estate leading the way at 15.47%, followed by the US Stock Market at 12.07%, the International Market at 10.51%, Emerging Markets at 7.86%, the US Bond Market at 6.82% and the Global Bond Market at 5.36%. To view our Quarterly Market Review Slide Deck Click HERE.

Mike’s Commentary and Client Questions

I think it would be helpful to break this section into 2 different pieces. The first section being Core beliefs that are imbedded into our MWA Portfolios, and the second section will cover some client questions that we have received over the past month.

CORE Beliefs that are embedded into MWA portfolios:

- Long-Term Approach: We prefer the tortoise over the hare.

- Markets work well to price information: What this really means is information from yesterday and the past is already inside prices and, if the information doesn’t change and all the assumptions about the future that was in those prices comes true, the prices would not materially change. It is, therefore, only new information that changes prices (for the better or the worse).

- Market Prices are usually pretty-right – Everyone is smarter than just a few of us (which is why prices are mostly right). Every now and then prices get off base (and the few that figure this out can make a lot of money, if they make a big wager on being right), but these mispricing’s are hard to spot and after accounting for cost of trading and taxes, most investors are better off to buy and hold than to sell (because being right over and over is very difficult to do. A 55%-60% batting average is considered outstanding for most Mutual Fund Managers. Because it is difficult to win, most professional money managers cannot beat just buying the entire market and holding on over the long run.

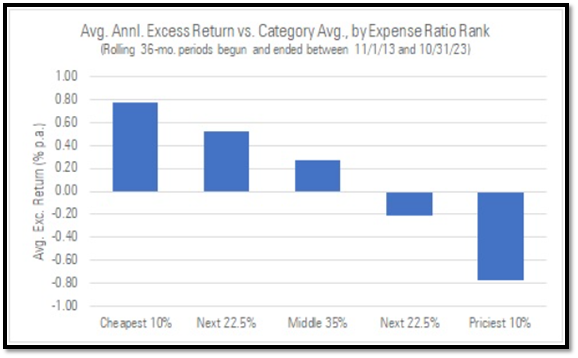

- We are Evidence Based Investors – meaning we follow the research in academia and try to leverage what has been proven to work and avoid strategies or concepts that often have not worked. In these studies –Low-Cost Investments usually outperform similar high-cost investments.

- DFA & Vanguard offer 2 of the lowest total cost methodologies and their tools work very well. Additionally, both firms receive some of the highest ratings for taking care of their investors and for alignment of interest from Morningstar.

- Leverage Academia: The field of Behavioral Finance has tracked investors in thousands of studies, this information applied to the future can help us become better investors. A core thread that runs through studying investing is that human beings are susceptible to many biases that can make it difficult to be successful investors. Warren Buffet said Investing “Is Simple, it’s just not easy.” I believe finding a disinterested 3rd party that cares about you and your family and who understands the emotional aspects of investing combined with prudent investing rules and is someone you trust is key to overcoming the temptations to giving in to fear, greed, and envy.

- Diversification is the closest thing to free lunch in investing. Because the future is uncertain the safest way to invest (if you do not know the future and you are not making a bet) is to transfer as much risk as possible without giving up too much return. If we assume that all the equity investments in your portfolio have an expected return of exactly 10% (some are more but let’s assume this is the case) and the S&P500 has an expected Return of 10% as well, I would want as many slices as possible that would be expected to generate 10% albeit at different times. In hindsight it is easy to think that looks obvious (this is called hindsight bias). Because markets are forward looking expensive markets are expensive for a reason, and inexpensive markets are less expensive for a reason. Over time when buying classes of investments (not 1 company) owning the more out of favor investment has generally been a sure-fire way to win as long as the investors don’t jump off the ride in the middle before the investment achieves its targeted return (or its average return).

- Reversion to the average return is the strongest force in financial markets. – Lots of reasons for this but competition is fierce. If a company has a moat others make knock offs and complements. Look back at Kodak, AT&T, GE, Enron, and others.

The 2 Client Questions I’d like to answer:

- How have the investment tools (I own) performed over time? (Below we will examine the DFA Equity Funds). We also own Vanguard Funds, on the Bond side of the Portfolio, I’m going to save Vanguard for another day. The Vanguard funds cost 0.10%/year and are effectively owned by their shareholders, which keeps their costs low and awesome.

- Why does my black diamond return look low (when compared to the NASDAQ or S&P500 or even the US Stock Market?)

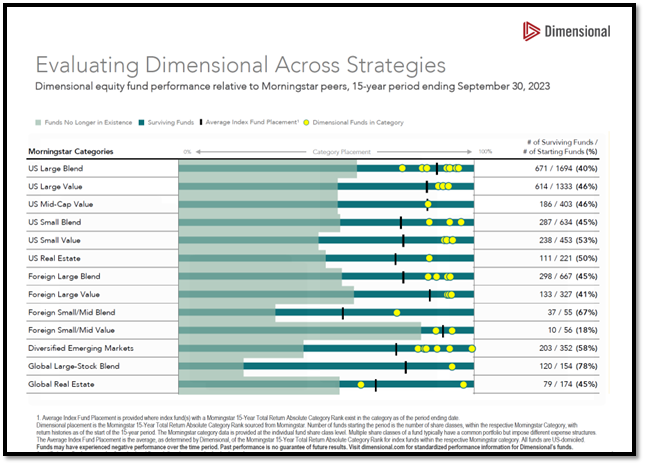

Question #1: How has DFA (Equity funds) performed vs their peer group? Crushed It. If you look at a picture on Black-diamond and it does not appear that your DFA equity funds are doing well, we may need to adjust your settings or find some additional outside material that can help you feel confident that the answer to this question is “yes” these funds are doing an outstanding job of capturing the returns equity markets offer and the extra premiums that can be captured in value, smaller companies, and in high profit companies. (It is best to see this when looking over rolling periods of time). The best way to see that your individual holdings are doing well is to make sure that we are isolating each investment by its respective category, and not looking at all the positions in your portfolio at once. This helps us compare apples to apples, over similar time periods. Remember, comparing different time periods can influence the returns. Please examine this picture below:

The vertical line in the picture represents the index fund that most closely represents the benchmark for the DFA fund listed in its prospectus. The yellow dot is each of the DFA funds in that category. Remember indexes cannot be bought directly. Indexes are tracking tools with no fees removed, so for an actual fund to consistently beat an index after fees are removed is a feat. Just looking at the yellow dots, I believe it is easy to tell DFA is better than most indexes funds, and a lot better than most their peer investment managers (esp. when survivorship data is counted (the shaded area). I believe DFA’s investment record in equities is unparalleled, that’s why we continue to use their flexible indexing methodology.

In my opinion, when a company like DFA wins consistently over longer periods of time, broadly across a diverse portfolio of products, it is because their methodology currently works. We also believe and monitor that it is likely to continue to work into the future. Please understand that most of DFA’s product portfolio was not created 40 years ago when they built their 1st funds, they have evolved and grown with success. Many of their newer funds are only trackable for 15-20 years while the strategy has actual trading data. However, because their funds are rules-based indexes it is possible to see how a similar strategy would have performed using the CRISP Database farther back into the past.

If you would like to see more performance info, please click HERE.

Question #2: Why does my black diamond return look low? (when compared to the NASDAQ or S&P500 or even the US Stock Market?)

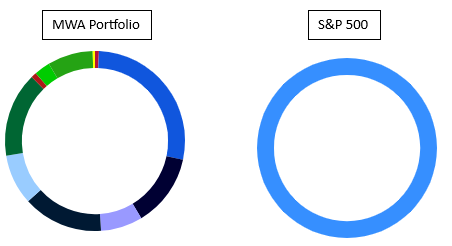

The simple answer: It’s more diversified and it has more pieces than just the US portion of the portfolio. The International markets and some of the smaller companies have not performed as well as the large cap US indexes recently. There is usually a difference between a portfolio and the pieces in a portfolio. Normally a portfolio will cover all of the investment pieces tracked in a portfolio group not just stocks. This begins with a sliver of cash, emergency funds, and the various offensive and defensives strategies used in your plan.

A portfolio at MWA is designed to lower long-term risk of plan failure and typically made up of 3 main components:

- Defense (Mostly high-quality Bonds, taxable and tax free): The objective of high-quality defense is to protect equities. Most defensive will have returns that is 33-50% below offensive asserts. Most of the time over longer periods of time a diversified portfolio of offense and defense will produce equal or higher rates of returns than an all-offensive portfolio, because declines are hard to predict. A core component in prudent portfolio design is negative correlation.

- Alternative assets: These are typically used to protect against large declines. This might be a hedge fund, Mortgage REIT, Gold, Bitcoin fund/ETF, or Gas Pipelines, a commodity fund or energy reserves.

- Offensive strategies (these strategies typically own stocks and real estate in different locations and may weight positions differently based on the prospectus. Normally offensive strategies may perform better in risk on environments or when people are optimistic. (example high inflation environment, or low inflation environment).

A portfolio built with this kind of diversification is not supposed to have the highest return every year and it may never actually have the highest return in any given year, but it’s built to win over the long run. A diversified portfolio is one that should have good returns every year but may never actually be the top performer. Since most investors are investing for the long term, having the long term view we talked about earlier is paramount.

A lot of people use the phrase “long term investing is more like a marathon than a sprint”. I disagree, it’s more like a decathlon than a running event. As the name suggests, the decathlon consists of 10 track-and field-events completed over a two-day period. On the first day, athletes compete in a 100-meter dash, long jump, shot put, high jump and 400-meter run. The second day includes 110-meter hurdles, discus throw, pole vault, javelin throw and a 1,500-meter run. Many different skills are being used, similar to investing there are a number of different skills being used to win.

Jim Thorpe is known as one of the greatest athletes of all time. He was the first to win the decathlon in its current iteration in the Olympics back in the 1910s by a wide margin. However, according to Olympepedia.org, he only won 3 of the 10 events in the Decathlon! The reason he won was that although he only won 3 events, and he was near the top on the other 6. This is how our portfolio should work, being at or near the top in most every year, although it may never actually be the winner in a given year.

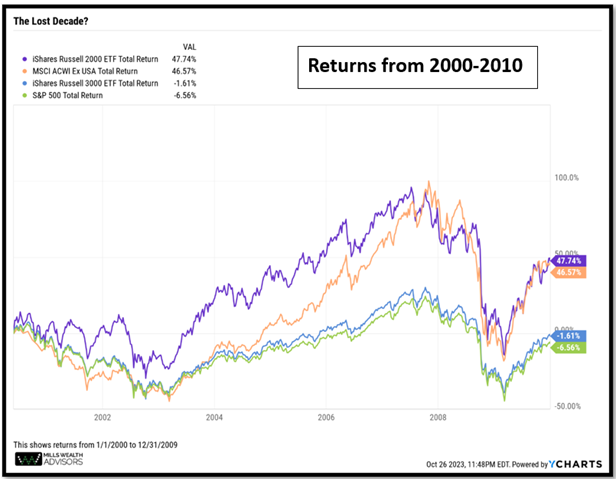

Today, depending on risk and whether an investor is in the growth stage or the income stage, Portfolio Allocations use a global portfolio approach vs just a US only portfolio. The picture to the side shows returns in the 2000s. Many of us don’t remember this, but in the 2000s the S&P 500 was one of the worst investments you could have. The Total US Stock Market beat it, Small Caps beat it, and outside the US beat it, pretty handily too. Does that mean it shouldn’t be an investment to buy? No! It just shouldn’t be the only thing you own if you are a long-term investor who wants to win in the long run.

The US is the greatest country in the world, operating in the best time for US power ever. There is much good news priced into US equity prices. Today the US is the only real superpower which has fueled our growth for the last several decades. I think it is likely we will be entering a climate with more political tension, that could cause markets to become less optimistically priced. This is just one reason we own assets around the world large and small offense and defense. Also, smaller companies’ indexes have underperformed large company indexes like the S&P500. I suspect risk and return are still related and that small companies will eventually pay investors larger returns than less risky large company indexes Reversion to the mean is one of the strongest forces in finance.

Your individual portfolio returns will look different than the indices that you look at because by and large, your portfolio is a compilation of indices built to win the decathlon, or the marathon rather than the 100-meter dash. We have built your portfolio to win your specific “event” or goal. Over the long run they should hit your goal, but in a different path than an individual index would.

Tax Corner – Things You Should Know for 2024

The IRS has issued new mandatory electronic filing (e-filing) requirements for all Federal tax filers. In the past, taxpayers were required to e-file a specific tax form if they were filing 250 or more of that specific form. However, beginning in the 2024 calendar year (which would be 2023 tax return filings), any taxpayer who files 10 or more informational returns in total will be required to e-file all returns. In summary there 2 major changes to the e-filing requirements:

- The e-file threshold number decreased from 250 to 10; and

- Taxpayers must now apply this lower threshold to the aggregate of all information returns across all form types.

An informational return is a document provided by an employer, bank, financial institution, or other payer to the IRS to report the amount of income they have paid you. The types of forms/information returns affected by the new e-filing requirements that must now be aggregated include, but are not limited to, the following:

- Form W2

- Form 1042-S

- Various Forms 1099

- Various Forms 1098

If you receive any of the above forms, that does not count towards your aggregate total as these documents will be provided to the IRS on your behalf. The aggregate total is impacted if you are required to prepare/provide these forms to another person or business.

This new e-filing requirement will likely have the biggest impact on business owners and self-employed individuals – however, you should verify with your tax preparer whether this change will impact your 2023 tax filing.

Around the MWA Office

It’s been a long time since we last had an event. We’d like to blame it on COVID, but that’s not really true – we just simply got out of the habit. We had the rare opportunity to have Weston Wellington (a Vice President at DFA) come speak to our clients and guests on January 9th. Thank you to those who came out and to those who shared their desire to come but could not. We enjoyed seeing and hearing from all of you, and we hope you left feeling better about your investments than before.

We intend to have more events – some fun, some educational – this year and in coming years (this time with a longer RSVP window, we promise)! So be on the lookout for invitations to these events both in person and virtual, and we look forward to seeing you!