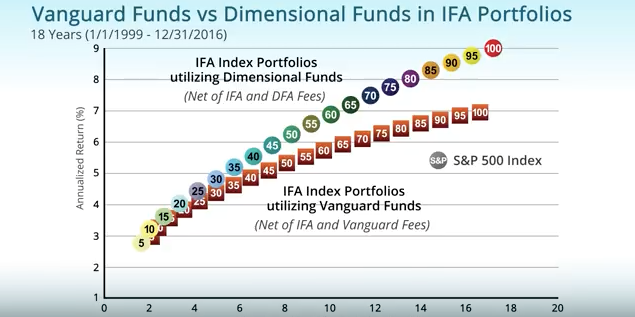

The following video by one of our peers at IFA does an outstanding job of explaining how Dimensional Fund Advisors’ methodology captures more of the 3 factors that drive higher expected returns. (Click HERE to see what the 3 Factor Model is) When compared to Vanguard and other index fund

Question: My Disability policy has an automatic increase rider built into the policy. Each year we receive a premium increase of $100 for benefit increase of $320. Should we accept this increase or decline the increase? Answer: That’s a good question and as with most answers in financial planning it

A great article on facts about financial aid eligibility. Check it out HERE Enjoy!

In the article below, Peter hits the nail on the head with his point about cost. Many articles fiercely debate which is better: active management or passive management. Attempting to out-guess other portfolio managers (active management), these articles often promote index funds (a form of passive management) as superior to

Have you ever wondered why a blindfolded monkey can often beat professional money managers? This short article helps explain why. Enjoy!

Are Advisors Losing Faith In The Buy and Hold Approach Thesis: Both clients and advisors have a hard time letting markets work over the long run. It takes an incredible amount of discipline and patience to stock with a prudent, low-cost buy-and-hold approach when the world appears to be falling

We are honored to be quoted in Forbes about one of the innovative strategies we are using in our back office to increase transparency into our successful time-tested investment process. The Core+ methodology™ uses academics, and the peer review process to filter and test the best ideas from academia. We

At MWA, one of our core investing beliefs is that risk and return are related. As such, there are three known investment factors that offer higher returns to long-term, patient investors. One of these factors is that small companies offer nearly a 3% annual premium compared to big companies. While this is well

Executive Summary: “Structure Determines Performance” In the following presentation, investors will learn how to build an institutionally weighted portfolio that is considered optimized and efficient. Each slide adds a different asset class (type of investment), and investors will be able to see how each slice of the portfolio’s pie affects

Mills Wealth Advisors refuse to be fee-only here is why At Mills Wealth Advisors, LLC, our team of Certified Financial Planning professionals are 100% committed to acting as fiduciaries, the highest legal standard in a client/advisor relationship—a standard we believe all clients should demand! I believe any advice not delivered