James built and sold a company for eight figures. He didn’t inherit wealth. He created it—through grit, risk, long hours, and an unwavering belief in what he was building. Today, James is worth over $10 million. But here’s the twist: You’d never know it. He doesn’t drive the nicest truck

The stock market is expected to be down another 2% today. Do these 4 things before you decide to buy or sell. I’m sure you’ve heard “Buy the dip” a million times in the past 5 years. As a wealth advisor, I know I have! Investors have become increasingly smart

A study from the Department of Health and Human Services (HHS) indicates that approximately 49 percent of men and 64 percent of women who turn 65 today will require substantial long-term care at some point during their later years. Supplementing this information, the National Association of Insurance Commissioners (NAIC) reported

Early in my career as a financial advisor, clients would often ask me:“What number do I need to retire?” They believed that hitting a certain financial milestone was the key to freedom. And for a long time, I believed it too. I’d run the calculations, project the returns, and set

Why Converting Your Home into a Rental May Be a Bad Idea: Many homeowners, when moving out of their primary residence, consider turning it into a rental property instead of selling it. On the surface, this may seem like a great idea, especially in high-appreciation markets. However, there are several

As a business owner, you’ve worked hard to build your wealth. When it’s time to plan for the future, one question many of my clients ask is: “Can I charge my estate planning fees to my business?” It’s a smart question. After all, why not have your business cover these

I love golf. But every day for the rest of my life? No chance. Thousands of people fall into the same trap when they retire: they assume that more leisure, more golf, more travel, more relaxation, is the key to a happy retirement. But after working with hundreds of retirees,

Starting in 2025, retirement savers in their early 60s will have an exciting new opportunity to boost their savings. Thanks to the Secure Act 2.0, individuals aged 60 to 63 will be eligible for increased catch-up contributions—what’s now being called the “super” catch-up contribution. This change aims to help older

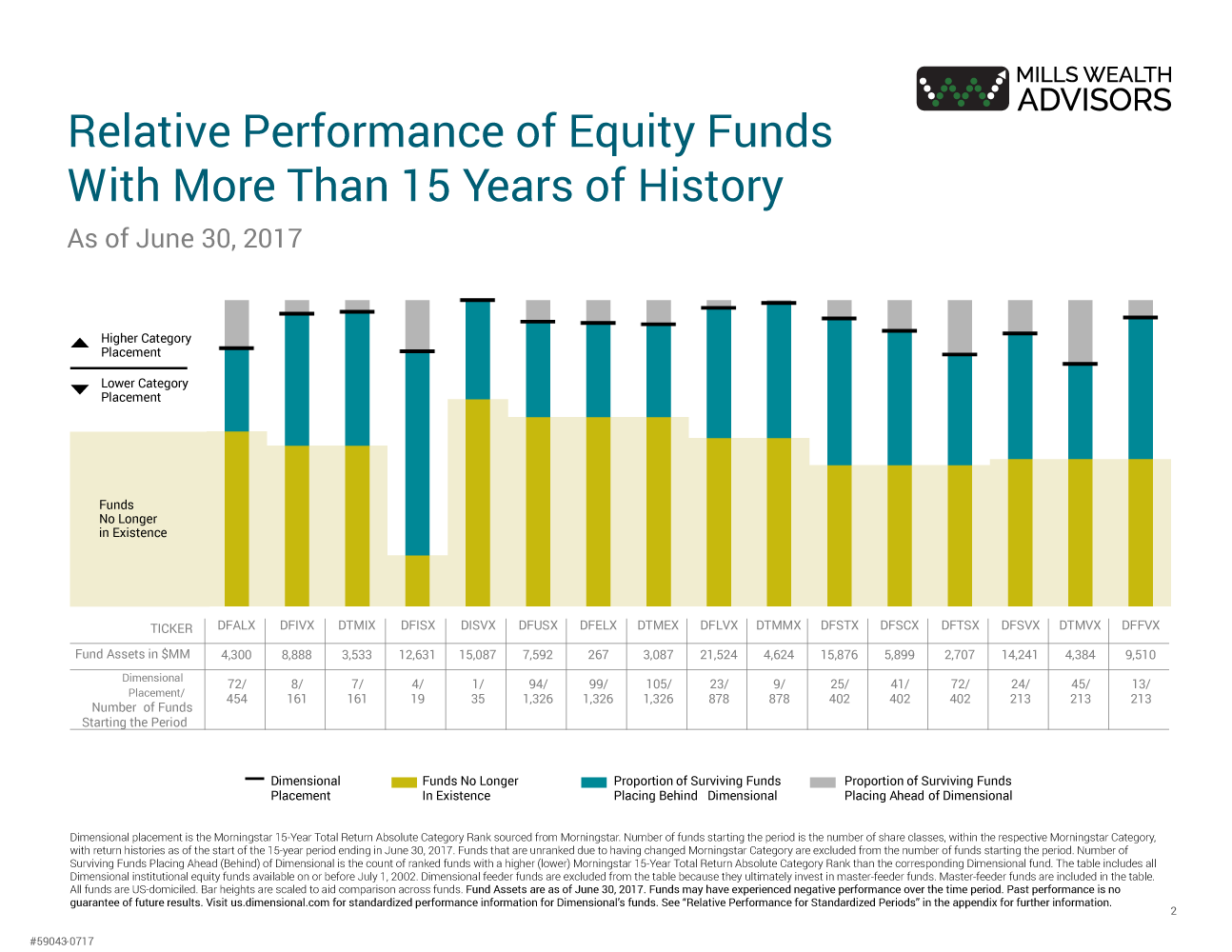

I think this one graph shows why we use DFA‘s methodology. I believe DFA’s evidence-based approach, has worked, is still working, and should work in the future. In investing many costs are hidden, and DFA’s low turnover approach handily beats most higher-cost investment options (even if that cost is hidden

We received a really good question that I wanted to share with all of our clients and those who follow us online. “An old and trusted indicator in the bond market is warning about possible trouble ahead in the economy and the stock market. What should I do?” In the