When you become a parent, you will likely start to do everything in your power to set your child up for success. For some parents, this might include opening and funding an investment account for their children. However, before parents decide to go down this route, they should familiarize themselves

Tax season can be a stressful time, especially for small business owners and self-employed individuals. With so many moving parts, it’s easy to overlook valuable tax deductions that could significantly reduce your tax liability. Fortunately, the IRS offers a range of deductions specifically tailored for business owners – and those

DOWNLOAD THE PDF Each Quarterly Newsletter we strive to focus on commenting on the previous quarter. However, after what has transpired the past 10 days in April it feels more pertinent to discuss what is going on right now, mixed in with some of what we saw during the first

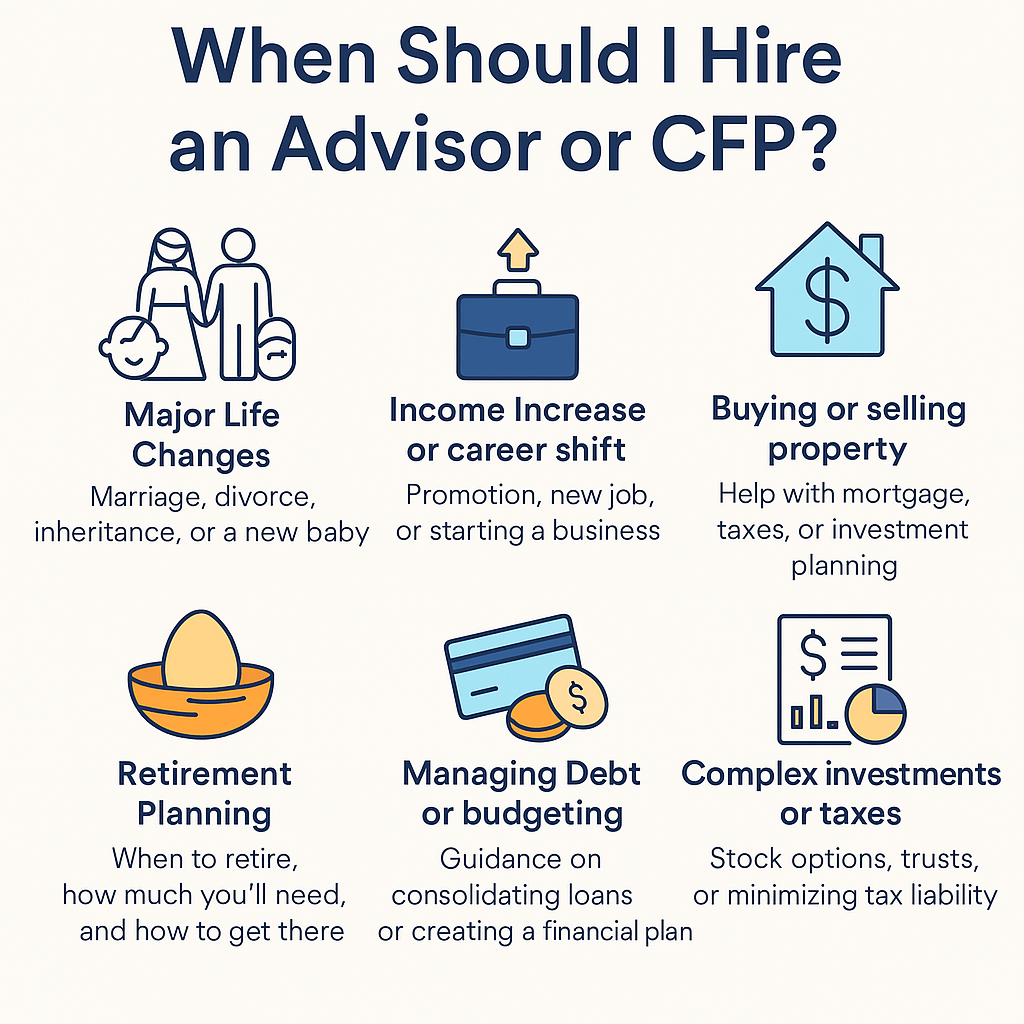

Before we begin to address the question of when to hire a financial advisor, it is essential to first understand what a financial advisor is and what their role entails. A financial advisor is a professional who helps people manage their financial situation and reach their financial goals. This involves

The first quarter of 2025 started off on a positive note, with most major markets posting gains. Leading the way were International Developed Stocks, up 6.20%, followed by Emerging Market Stocks at 2.93%, the U.S. Bond Market at 2.78%, and Global Real Estate at 1.37%. On the downside, the Global

As part of the SECURE 2.0 Act, owners of 529 plan accounts can now make tax- and penalty-free rollovers to a beneficiary-owned Roth IRA retirement plan account. This change provides more flexibility to families who worry about having unused or leftover funds in their 529 plans. Before the SECURE 2.0

As a business owner, you’ve worked hard to build your wealth. When it’s time to plan for the future, one question many of my clients ask is: “Can I charge my estate planning fees to my business?” It’s a smart question. After all, why not have your business cover these

I love golf. But every day for the rest of my life? No chance. Thousands of people fall into the same trap when they retire: they assume that more leisure, more golf, more travel, more relaxation, is the key to a happy retirement. But after working with hundreds of retirees,

Once again, the BOI Reporting requirements have changed. The most recent announcements from the Financial Crimes Enforcement Network (FinCEN) and the U.S. Department of the Treasury provide some clarity and temporary relief regarding the Corporate Transparency Act’s (CTA) Beneficial Ownership Information (BOI) reporting requirements. These developments, which could significantly alter

When it comes to investing, avoiding costly mistakes is essential for building long-term financial security and achieving your financial goals. Investment errors can not only erode wealth but also set you back years in your financial journey. Here are some common pitfalls to avoid. Lacking a clear financial plan It

Stop by our Southlake wealth-management office, just off TX-114 and minutes from Westlake, Trophy Club, and Colleyville, to meet the team that’s guided North Texas families and business owners for 25 years. Mills Wealth Advisors delivers fee-only financial planning, retirement-income strategies, tax-efficient investing, and exit-planning expertise to clients across the Dallas-Fort Worth metroplex. Tap the map below for turn-by-turn directions or give us a call to book your complimentary discovery meeting today.