Most people who fail don’t fail because they don’t try, it is usually because they don’t have the right system to create success. Success is intentional and so it is no surprise to learn financial security doesn’t happen by accident; it requires planning and intentionality. Whether you aim to pay

What will happen to your business if you’re no longer around to run it? Too many business owners put off this question, but failing to plan for the unexpected can be costly. Whether its due to death, disability, or retirement, it can leave your company, employees, and loved ones in

As a business owner, you’ve worked hard to build your wealth. When it’s time to plan for the future, one question many of my clients ask is: “Can I charge my estate planning fees to my business?” It’s a smart question. After all, why not have your business cover these

I love golf. But every day for the rest of my life? No chance. Thousands of people fall into the same trap when they retire: they assume that more leisure, more golf, more travel, more relaxation, is the key to a happy retirement. But after working with hundreds of retirees,

Why Estate Planning Matters Estate planning is not just for the wealthy, it’s a crucial process for everyone, ensuring that your assets are distributed according to your wishes and that your loved ones are not burdened with unnecessary legal and financial challenges. Proper planning also prepares for unforeseen circumstances, such

Starting in 2025, retirement savers in their early 60s will have an exciting new opportunity to boost their savings. Thanks to the Secure Act 2.0, individuals aged 60 to 63 will be eligible for increased catch-up contributions—what’s now being called the “super” catch-up contribution. This change aims to help older

Why Most People Fail at Setting New Year’s Financial Goals (and How to Succeed) Every year, millions of people set ambitious financial goals for the New Year. They vow to save more, spend less, pay off debt, or finally start investing for the future. But as the months roll by,

As wealth management strategies evolve, one financial tool has remained a key consideration for high-income earners: the Backdoor Roth IRA. This strategy allows individuals who exceed the income limits for Roth IRA contributions to still take advantage of the tax benefits that Roth accounts offer. But how does it work, who is

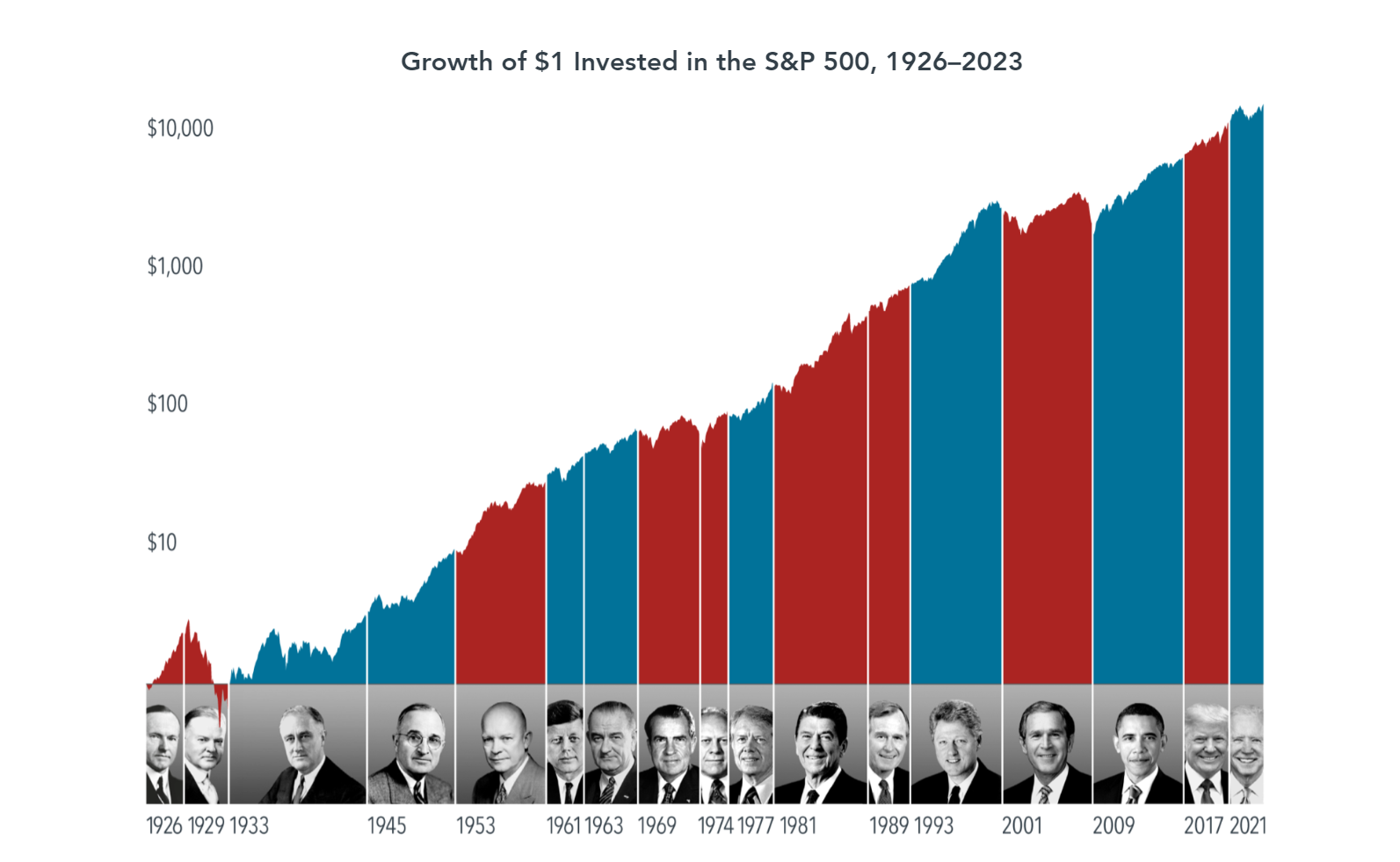

With the election less than 6 weeks away many investors worry about how the election is going to affect their portfolio. The truth of the matter is that if you are a long term investor, jobs reports, GDP, and the election shouldn’t be something you should worry about. They are

We are thrilled to share that Stephen Nelson, a cornerstone of our team, has been honored with the prestigious D Magazine’s Best Financial Planners for 2023. This accolade is a testament to Stephen’s expertise, dedication, and the strategies he employs to ensure our clients’ are well taken care of. His